How Much Is a Gold Bar Worth?

Live Gold Bar Prices by Size

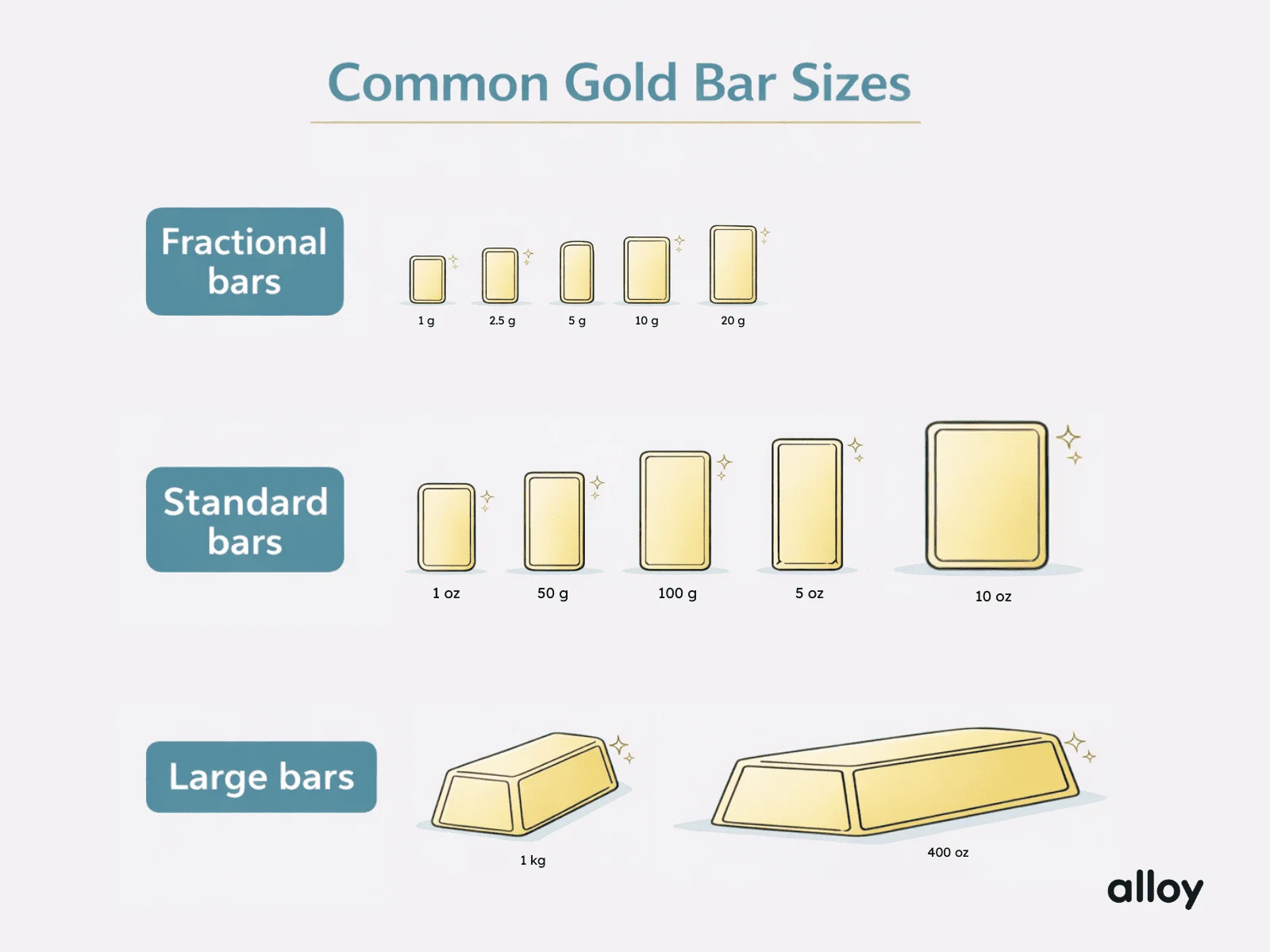

Gold bars come in many sizes, offering investors different ways to enter the market, from small fractional bars to large commercial bars used in institutional trading. So, how much is a gold bar worth? In most cases, it comes down to three numbers: the bars’ weight, purity, and the live gold spot price. Together, these three factors determine the melt value, the baseline for gold pricing.

This page breaks down common bar sizes and shows the live-updating melt values for each. Keep in mind that real-world buy and sell prices can be higher or lower than melt value due to dealer premiums, brand premiums, and buyback spreads. While premiums vary, melt value always starts with the same market math.

Gold Bar Price Today (Live Melt Values)

This section serves as an at-a-glance reference to common gold bar sizes and their current, live-updating melt values, based on today’s gold spot price. Sizes range from 1 gram to 400 oz. Fractional sizes as small as .5 gram do exist, but are not included in this table.

Note: The values below show the live melt value (the raw gold value based on today’s spot price). Actual buy and sell prices can be higher or lower due to dealer premiums, brand premiums, and buyback spreads, especially for smaller bars.

Gold Bar Melt Value Calculator

The simplest way to estimate what a gold bar is worth is to calculate its melt value, the raw market value of its gold content based on today’s spot price. Enter the bar’s karat purity (most investment gold bars are 24K) and its weight, then click calculate.

Keep in mind that the melt value is a baseline. Actual buy and sell offers can vary depending on dealer premiums, brand demand, and buyback spreads.

Gold Bar Value Calculator

Current Market Value:

$0.00

Average Pawn Shop Offer:

$0.00

Alloy’s Estimated Offer:

$0.00

Tip:

If your bar is stamped 999 or 9999, select 24K. The calculator treats 24K as pure gold, so results may differ slightly from .999 or .9999 bars.

Quick Formula: How to Calculate Gold Bar Value

Two factors affect the value of gold bars: their melt value and premiums. Understanding how these two factors work together to determine the final purchase or sale price is integral to understanding the true value of any gold bar.

Melt value formula

The baseline value for any gold bar is the melt value. To calculate the melt value, one needs to know the purity, weight, and spot price of gold.

Purity x weight x spot price = melt value

Gold is currently trading at $5099.37 per troy ounce, so a 1 oz .9999 gold bar has a melt value of about $—.

Why your buy/sell price won’t match melt

Retail premiums, dealer buyback spreads, and a bar’s brand and packaging affect the final purchase and sale price. Here’s how each factor influences the final price of a bar at purchase and sale.

Retail premiums

A retail premium is the amount above the melt value that a buyer pays when purchasing a gold bar from a dealer. Dealers charge premiums to cover operating costs such as production, distribution, insurance, storage, shipping, and other expenses required to bring physical gold to market.

The biggest driver of retail premiums is the bar size. That’s because it costs the same amount to produce, package, ship, and sell a 1-gram gold bar as it does a 1-kilogram gold bar. Those expenses do not scale down with the size of the piece. As a result, buyers typically see:

- Higher premiums per gram on 1g to 10g bars

- Moderate premiums on 1 oz bars

- Lower premiums per ounce on 10 oz to 1 kg bars

While smaller bars can be more convenient to purchase, store, and sell, they usually carry a higher premium per ounce than larger bars.

Dealer buyback spreads

When selling a gold bar back to a dealer, sellers may find their offer is lower than the melt value due to the dealer’s buyback spread. This spread is the difference between what a dealer sells a bar for and what they’re willing to pay to buy it back.

Example: If gold has a spot price of $5,100/oz, a dealer might sell it for $5,220 (with a premium) and buy it back at $5,040 (at a discount).

Buyback spreads exist because dealers take on risk when purchasing physical gold. Gold could drop before the bar is resold, and authenticating and testing take time and money. Dealers also incur inventory carrying costs, may face changes in market demand, and must account for the risk of fraud or counterfeit bars.

This spread depends heavily on the bar. A dealer may pay close to spot for well-known, common-sized bars sealed in their assay packaging. Offers may be lower for obscure brands, damaged bars, bars without packaging, or those that require additional testing.

In other words, the melt value is a baseline, but the spread determines the real-world buy and sell price.

Brand premiums

While a brand name does not affect a gold bar’s melt value, it can affect its resale potential, creating premium differences in the market. Well-known refiners tend to have stronger demand because buyers trust their consistent product quality, standardized marking, and predictable specifications.

In general, recognized brands are easier to authenticate and resell, which may result in slightly higher premiums, especially for smaller bars.

Brands that can command stronger premiums include:

- PAMP Suisse

- Credit Suisse

- Valcambi Suisse

- Perth Mint

- Royal Canadian Mint

- Sunshine Minting

Brand premiums are most noticeable in smaller bars (1g to 1 oz), while larger bars (10 oz and 1 kg) often trade closer to their raw gold value.

Packaging

Packaging does not affect a gold bar’s melt value, but it can affect what someone is willing to pay for it. Bars in their original assay packaging may command a higher premium than loose pieces, since sealed packaging makes the bar easier to verify and resell.

Assay packaging is a tamper-evident card that typically includes the refiner’s name, the bar’s purity and weight, and often a serial number. Some assay cards also include a certifying signature. Together, this information increases buyer confidence and can lead to strong resale demand.

Buyers are generally more willing to purchase bars from well-known refiners in their original packaging because it reduces the need for additional authentication and lowers the perceived risk of counterfeit bars. This can make the bar easier to sell quickly and may help narrow the buyback spread.

If a bar has been removed from its packaging, it may sell at a slightly lower premium and be treated more like generic bullion. In many cases, it will require additional testing to verify authenticity, which can affect how quickly it sells and what a buyer is willing ot offer.

For this reason, many investors keep assay packaging intact whenever possible, especially for smaller bars.

What Determines the Value of a Gold Bar?

While the baseline for determining a gold bar’s value lies in weight, purity, and the current spot price of gold, in practice, actual buy and sell prices can vary. Factors such as bar type (minted vs. cast), brand recognition, condition, and the ease of authentication all affect resale offers and influence premiums.

- Weight: Gold bars are commonly labeled in grams, troy ounces, or kilograms, and larger bars typically have lower premiums per ounce than smaller bars.

- Purity: Higher-purity bars contain more gold, and most investment bars are 24K, typically marked with 999 or 9999 fineness.

- Minted vs. cast bars: Minted bars often command higher premiums due to their appearance and resale demand, while cast bars are more common in larger sizes and may trade closer to melt value.

- Brand recognition: Trusted mints and refiners are easier to resell and may command stronger premiums due to buyer confidence and demand.

- Condition + packaging: Bars sealed in original assay packaging may resell more easily and reduce verification concerns, while loose bars may require additional testing.

- Authenticity & verification: Bars that are easier to authenticate (clear markings, serial numbers, standard dimensions) often receive stronger resale offers than bars that require extensive testing.

Common Gold Bar Sizes and Live Melt Value

Gold bars come in many different sizes and weights. In the section below, the guide below breaks down the live melt value of common bar categories, from fractional gold bars to the most common 1 oz gold bar, standard investor sizes, larger 10 oz gold bars, and institutional 400 oz bars. The prices shown reflect melt value only (the raw gold value), and do not include any dealer premiums, brand premiums, or buyback spreads.

Fractional gold bars (1 g to 20 g)

Fractional gold bars make it easier for both new and seasoned investors to buy smaller amounts of gold. Common fractional gold bar sizes range from 1 g to 20 gand are widely available from bullion dealers. Because production and packaging costs don’t scale down with weight, fractional bars typically carry higher premiums per gram than larger gold bars.

1 oz gold bar melt value (most common size)

The most common size of gold bar is the 1 troy ounce (1 oz). Because it’s a standard bullion size, it’s simple to price and tends to track the current spot price closely. One-ounce bars are widely available from major refiners and bullion dealers, and they are typically among the easiest sizes to resell.

How much is a 1 oz gold bar worth?

Standard gold bars (50 g, 100 g, and 5 oz)

Standard gold bar sizes such as 50 g, 100 g, and 5 oz are popular among investors because their per-ounce premium is typically lower than that of fractional bars, while still offering strong liquidity and easy resale. They can be a sweet spot for buyers looking to reduce premiums without jumping to larger, more expensive bars like 10 oz or 1 kg.

10 oz gold bar melt value

10 oz gold bars are a popular choice for investors who want to lower their per-ounce premium while still buying a size that’s widely recognized and easy to resell. They are considered a larger retail investment bar but are still widely traded, not limited to institutional buyers.

The melt value of a 10 oz bar is generally straightforward and tracks the spot price closely. Because their weight is standardized, a 10 oz bar is typically priced near 10 times the spot price, excluding any premiums.

While 10 oz bars remain liquid, the buyer pool is generally smaller than that of a 1 oz bar. Keeping the bar in its original assay packaging (or retaining any accompanying documentation) can help streamline the authentication process and improve resale confidence.

Because a 10 oz bar is worth more than smaller bars, investors often need to consider storage and insurance options to protect their assets.

How much is a 10 oz gold bar worth?

1 Kilogram / 1000 g gold bar melt value

A 1 kg (1000 g) gold bar is considered a large investment bar in the retail market. While it’s still accessible to many retail investors, it’s far less common than a 1 oz or 10 oz bar. Kilo bars are often chosen by buyers looking to consolidate their holdings and drastically minimize their per-ounce premiums.

Kilo bars are widely recognized and can still be easy to sell through reputable dealers, but the buyer pool is even smaller than for 10 oz bars due to the higher entry cost.

These large bars typically come as cast bars, but may sometimes be available in minted or assay-sealed versions. Because of their size and value, buyers often expect additional testing to verify authenticity, even when packaging and documentation are present.

Because a 1 kg bar represents a high value in a single item, investors should consider storage, security, and insurance when holding gold of this size.

How much is a 1 kg gold bar worth?

400 oz gold bar value (Good Delivery Bars)

A 400 oz gold bar is commonly called a Good Delivery gold bar (often referred to as an LBMA Good Delivery bar) and is primarily used by institutions such as central banks, bullion banks, and large-scale global gold traders. Most consumers will never encounter this type of bar, since it’s typically held and traded within professional vault systems and is impractical to ship and store.

Although they are referred to as “400 oz” bars, a Good Delivery bar is not always exactly 400 troy ounces. Instead, these bars typically weigh between 350 and 430 troy ounces, averaging about 400 oz. So while the market refers to them as 400 oz, actual bars vary slightly.

400 troy oz ≈ 12.4 kg ≈ 27.4 lbs

Retail bars are often made of .999 or .9999 fine gold, but Good Delivery bars are typically produced to a minimum standard of .995 fine gold. Because of this, their melt value must take purity into account.

Premiums on Good Delivery bars are typically much lower than retail bars because they trade in wholesale markets, and their value is driven almost entirely by weight, purity, and the live spot price.

How much is a 400 oz gold bar worth?

Gold Bar Weight Guide (Grams to Ounces Conversion Chart)

Gold bars range from 1 gram to 400 troy ounces, but the most common retail size is 1 oz (31.1035 g). This chart shows the most common gold bar units and makes it easy to convert between grams and troy ounces when comparing bar weights.

Info:

Gold is priced in troy ounces. A troy ounce is heavier than a standard ounce.

1 troy ounce = 31.1035 g

1 regular oz = 28.3495 g

Trusted Gold Bar Brands

In gold bars, brand is less about luxury and more about liquidity, buyer confidence, standardized markings, and consistent quality. Reputable refiners and mints produce bars that are widely recognized, easier to verify, and easier to resell.

Most recognized gold bar brands

The following list of mints and refiners presents well-known and trusted companies in the precious metals industry. Bars from these producers often resell more easily due to their reputation.

Bars purchased from these companies should include the refiner or mint name or hallmark, purity (999/9999 or 24K), bar weight, serial number, and assay card details. Bars from other refiners or mints may require additional testing and sell for closer to the melt value.

- Credit Suisse – Credit Suisse bars are widely recognized and commonly traded on the secondary market, which helps liquidity and resale confidence.

- PAMP Suisse – PAMP Suisse is one of the most recognized retail bullion brands globally, which creates strong demand for its minted bars. Buyers are often more willing to pay stronger premiums for this brand, especially for small and 1 oz bars.

- Valcambi Suisse – Valcambi Suisse is a major Swiss refiner and is widely recognized in the global bullion market. This refiner is well known for its consistent specifications and clean markings, leading to broad acceptance among dealers and strong liquidity for bars.

- Perth Mint – Perth Mint is one of the best-known government-backed mints with a strong reputation in Australia and globally. Its government backing builds trust among buyers and creates strong resale demand.

- Sunshine Minting – Sunshine Minting is a well-known precious metals producer in the US and is widely recognized in the retail bullion market. Its gold bars are commonly traded and easy to resell through dealers, making them a trusted option for investors seeking strong liquidity and competitive premiums.

- Royal Canadian Mint – Royal Canadian Mint is another government mint with an extremely strong reputation for high-quality bullion products. Bars produced by this mint offer excellent liquidity and are often considered top-tier by buyers.

Do gold bar brands affect value?

A gold bar’s melt value is the same regardless of brand, since it’s based on weight, purity, and the current spot price. However, some buyers are willing to pay a premium for bars from trusted mints or refiners because they are easier to authenticate and often have stronger resale demand. Bars that remain sealed in original assay packaging can further increase buyer confidence by reducing uncertainty and verification time.

Buying a Gold Bar: How Much Does It Cost vs. Melt Value?

For first-time buyers, a common question is: how much to buy a gold bar? Beyond the melt value, the final purchase price can also reflect dealer premiums, shipping and insurance costs, and sales tax (where applicable).

What premium should you expect by size?

When purchasing gold bars, expect to pay higher premiums per gram for smaller bars than for larger ones. That’s because many manufacturing and operational costs (such as packaging, handling, and distribution) don’t scale down with bar size. Standard 1 oz bars typically carry a moderate premium, while large 10 oz and 1 kg bars often have the lowest premium relative to their size among retail bars.

Typical costs besides spot

When buying gold bars through a dealer, expect to pay a retail premium above melt value. Premiums help cover operating costs such as fabrication, distribution, storage, insurance, and other expenses involved in selling physical bullion.

When buying on the secondary market, sellers may also charge a slight premium for bars from well-known and reputable manufacturers. Depending on where a bar is sold, shipping and insurance may be added to the final cost. Some dealers may also charge additional fees based on payment method (for example, credit card purchases often carry higher costs than bank wire or ACH).

Some states may impose a sales tax or a similar tax on transactions involving precious metals and bullion. Because tax rules vary by state and purchase type, it’s important to confirm whether tax applies before completing a transaction.

Tips for buying gold bars safely

When purchasing gold bars, the seller matters. To protect an investment and reduce risk, buyers can take a few practical steps to help ensure they are purchasing authentic bullion.

- Buy from reputable dealers: Check a seller’s reputation before purchasing. Established dealers should have a consistent record of positive customer reviews and transparent pricing.

- Keep assay packaging and serial intact: Original, sealed packaging can increase buyer confidence and reduce verification concerns, since it helps show the bar has not been handled or altered.

- Avoid prices far below spot: If a seller is offering a bar at a price far below the melt value, it could be a warning sign that the item is counterfeit, misrepresented, or not investment-grade gold.

- Keep receipts and documentation: Save the original receipts and documentation to provide proof of authenticity at both the time of purchase and resale.