10-Year Gold Price Chart

10-Year Gold Price Chart (USD/oz)

How Gold Has Performed Over the Last Decade

The live chart above provides raw numbers, but it doesn’t tell gold’s whole story. Gold’s value has shifted dramatically over the past few decades, influenced significantly by market cycles and global events. The following section provides a closer examination of gold’s performance, the factors driving its long-term trends, and expert predictions for the years ahead.

How Much Has Gold Increased in 10 Years?

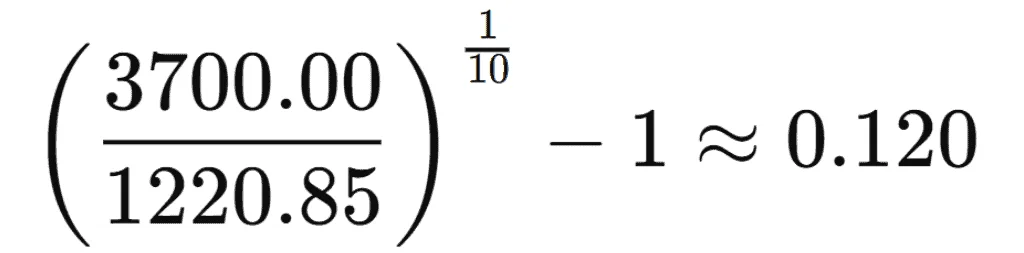

Gold prices rose from $1,220.85/oz in 2015 to new record highs of about $3,700/oz in mid‑2025, marking a gain of roughly $2,479 per ounce, or a growth of about 203% over the decade. Adjusted for inflation, the real increase is closer to 120%.

Let’s break this down with the Compound Annual Growth Rate (CAGR). This metric shows what yearly growth looks like if price changes were smooth, instead of up-and-down.

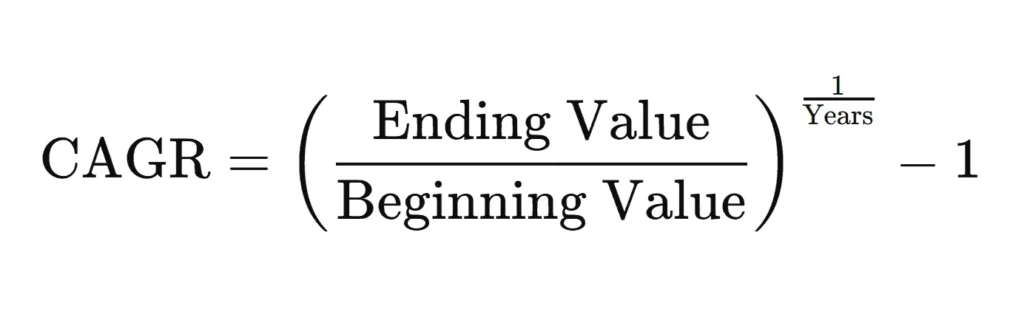

To calculate it, you would use this formula:

Using the numbers above, we get this:

That means gold’s price grew by about 12.0% per year on average over the past decade.

When we adjust for inflation, the CAGR drops to around 7.4% per year. Some view this as a robust return for a physical asset, especially one often considered a hedge against volatility. Others may argue that it still lags behind higher-risk investments, such as stocks, depending on the timing and market cycles.

Have gold to sell?

Request a free Alloy Appraisal Kit, ship from home, and receive a same-day offer after appraisal.

Have gold to sell?

Request a free Alloy Appraisal Kit, ship from home, and receive a same-day offer after appraisal.

Where Will Gold Be In 5 Years?

We at Alloy do not purport to be trend analysts and can’t say with certainty where gold will be in 5 years. What we can do is look to the experts who are doing just that.

The World Gold Council put out a mid-year report for 2025, saying:

“Our analysis suggests that gold may move sideways with some possible upside – increasing an additional 0%-5% in the second half. However, the economy rarely performs according to consensus. Should economic and financial conditions deteriorate, exacerbating stagflationary pressures and geoeconomic tensions, safe haven demand could significantly increase pushing gold 10%-15% higher from here. On the flipside, widespread and sustained conflict resolution – something that appears unlikely in the current environment – would see gold give back 12%-17% of this year’s gains.”

Deutsche Bank raises its 2026 prediction to $4,000/oz, citing continued central bank buying, a softer dollar, and expectations that rate cuts may help support gold prices.

That being said, investing is a personal decision, and returns can never be guaranteed. Historically, gold has been used more as a store of value than as an investment that chases returns.

Will Gold Be Worth More in 10 Years?

It would be nearly impossible to give a prediction for the price of gold in ten years. It’s doubtful anyone could have predicted the highs that gold has achieved in 2025 alone. One thing is for sure, however, gold has consistently held its purchasing power over time.

Investopedia highlights gold’s dual role as both “a store of value and a hedge against inflation.” It notes that factors such as economic forces, international events, and shifts in supply and demand all play a part in how gold is valued.

The Economics Observatory agrees, describing gold as “a reliable and solid investment over the long term”. At the same time, it emphasizes its ability to behave as a shield during financial uncertainty and global crises.

So what does this mean? No asset is immune to market fluctuations, but gold’s track record proves it holds its value when others may falter. The fact that it is physically scarce and its long-time demand allows it to remain relevant for centuries. It’s safe to say that while we can’t predict its price, gold has been and will likely always remain a safe bet.

Is Gold a Safe Haven Investment?

Gold has long been regarded as a safe haven by many investors. According to the IMF, you’ll see central banks increasing their gold holdings during economic or geopolitical insecurity. Gold offers stability when other markets may falter in times of uncertainty. Historically, gold has been valued for its ability to buffer against these sentiments.

The FTSE Russell report adds that part of gold’s appeal lies in its unique attributes; it is universally recognized and cannot be ‘printed’ like paper currencies can. These characteristics make it popular for diversification and risk management, especially when inflation is rising or geopolitical tensions are heating up.

All things considered, while it’s typically considered a safe haven, gold isn’t a perfect shield against all circumstances. During certain types of crises or when interest rates and inflation don’t perform as expected, investors may turn to other, higher-performing assets.

Is Gold a Good Investment?

The answer to whether gold is a good investment depends on what you hope to achieve with your investment. It doesn’t pay interest or dividends, but for many investors it provides a reliable store of value. A working paper from the National Bureau of Economic Research notes that gold is especially attractive when real (inflation-adjusted) interest rates are low or negative. Those types of conditions tend to push gold’s prices higher as investors seek to preserve their purchasing power.

At the same time, most investors don’t look to gold for long-term returns. Most diversified stock portfolios return, on average, roughly 9-10% over decades. But gold’s returns, historically, have been much lower. This is especially true when markets are stable and interest rates are going up.

While gold may not be a good investment on its own, it plays a crucial role in a diversified portfolio. When economic times are uncertain, or inflation or currency weakens, it shines as a store of wealth. But if you’re looking to get high returns from investing, you may want to look at other options.

When Investing in Gold

When investing in gold, it’s also important to consider your exit strategy. The Alloy Market wants to be your preferred gold buyer. Our process is safe, secure, and offers the highest payouts on the market. Request a free kit and send your items to us.

Once received, we will analyze them for purity, weigh them, and send you an offer. When you accept, we authorize your payment that same day. Let us make your gold-selling experience a smooth and stress-free one.