How Do You Sell Gold? – Balancing Emotions and Timing

Selling gold for the first time can feel complicated. To add to the overwhelm, it often comes with unexpected challenges. For anyone wondering how do you sell gold and what to expect, three experts share their insights. They highlight two often-overlooked challenges and provide practical suggestions for overcoming them.

By understanding these challenges and implementing the strategies, sellers can navigate the gold market with confidence. This approach helps achieve optimal outcomes when selling gold.

Want to sell your gold?

Request a free Alloy Appraisal Kit, ship from home, and receive a same-day offer after appraisal.

Want to sell your gold?

Request a free Alloy Appraisal Kit, ship from home, and receive a same-day offer after appraisal.

Recognize Gold’s Emotional Value

People often don’t realize the sentimental value of their gold until it’s time to sell. For instance, someone may have inherited something from a family member that they would never wear. When considering selling, the sentimental value still weighs heavily on them.

Brandon Thor of Thor Metals Group describes his first time handling a client’s gold sale, “I went into my first sale thinking it was purely about numbers, weight, and purity. What I didn’t realize was how deeply personal it can be for them.”

Gold isn’t just about its inherent value; it’s often tied to much more. “People inherit it from a family member, buy it to protect their savings, or see it as their legacy,” Thor states.

In a particularly emotional transaction with a client, he “remembers sitting across from a client who was hesitant to sell despite needing the funds. I could see it wasn’t just a transaction for him. It was about trust.”

At that moment, Thor realized his job wasn’t only to provide a way for people to turn their gold into money. “That moment changed my approach entirely. I realized my job wasn’t just about buying and selling. It was to guide, educate, and build confidence so clients felt secure in their decisions.”

So how do you sell gold when it’s a particularly emotional experience? When selling gold, it’s essential to check in emotionally about the decision before making it. Does this sale include something that someone will miss and cause regret? Does the buyer evoke a feeling of safety and trustworthiness?

Thor suggests doing business with someone who understands the emotional ties to gold. Building relationships is essential. A seller should always trust those to whom they sell their gold completely.

Balance Emotional Attachment with Financial Need

Eric Roach of Summit Metals reiterates the emotional attachment people have to their gold. “A 68-year-old woman inherited her father’s gold coins and broke down crying during our consultation, even though she desperately needed the $47,000 for medical bills.”

When someone is in a situation where they need money, the thought of parting with their belongings can be too great. It’s ok to reconsider the sale or make adjustments. It is better to pivot than be remorseful afterward.

Roach recalls how the woman adjusted her sales plan and found a happy medium. “That same client ended up selling 70% but kept three coins with the strongest memories. She got the cash she needed while preserving what mattered most emotionally.”

He also offers this practical advice when selling gold: “Factor in 2-3 extra days for emotional decisions, especially with inherited metals. I inform clients upfront that selling precious metals often involves emotional considerations or a family history. There’s no rush to make an immediate decision.”

Always work with dealers who understand that this isn’t only a transaction. Often it’s someone’s financial lifeline or family legacy. Roach suggests, “If they’re pushing you to decide on the spot, walk away.”

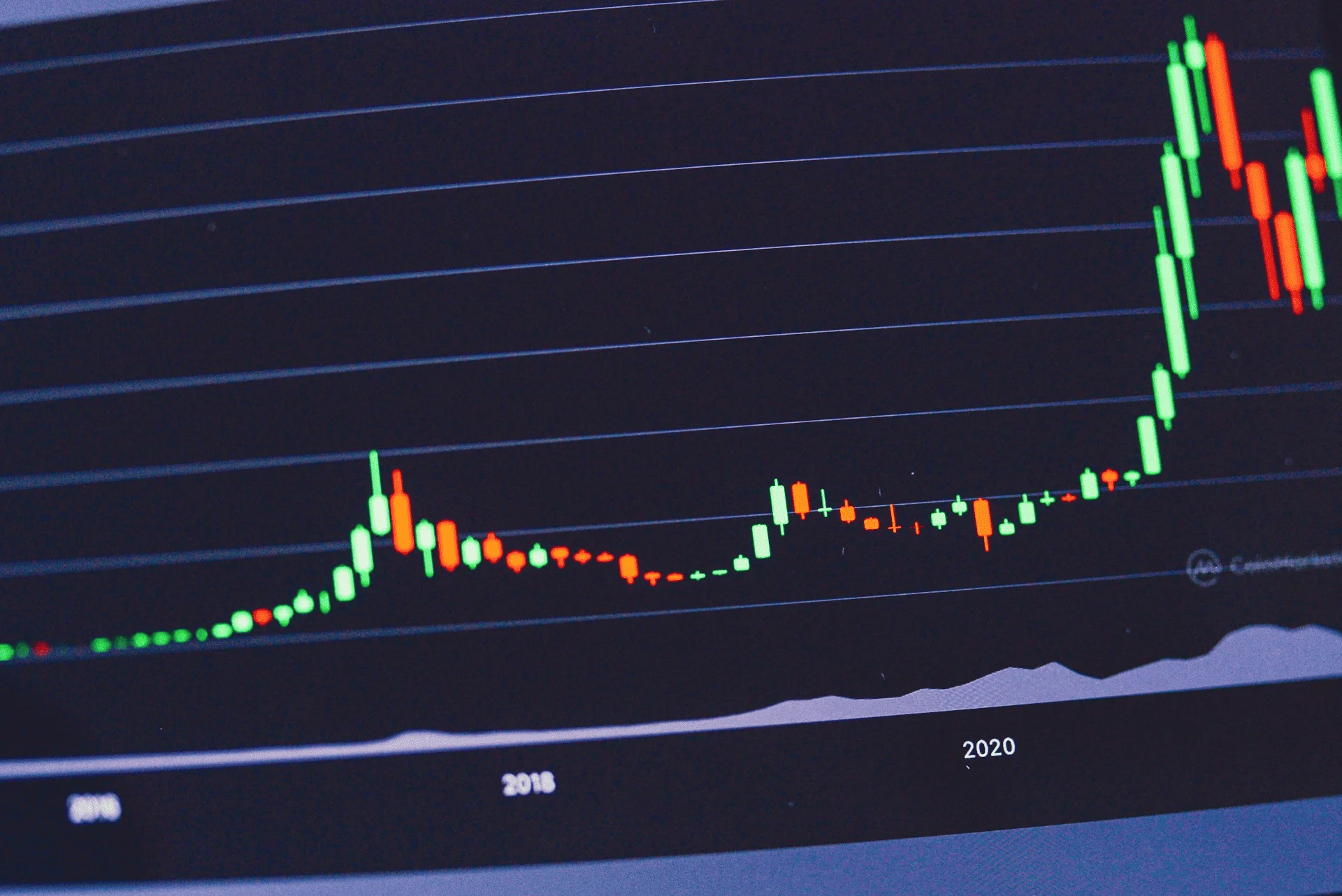

Develop a Clear Selling Strategy – Is It the Right Time to Sell Your Gold?

Determining when to sell their gold can be challenging for newcomers. They may not know how to time the market or what constitutes a good offer. Having a plan before selling gold is the simplest way to ensure selling at the right price and at the right time.

The President of Titan Funding, Edward Piazza, has this to say about his first time selling gold and learning to make a plan. “The hardest part for me was figuring out the right timing to sell. I kept second-guessing myself as prices fluctuated. After losing some opportunities due to hesitation, I developed a simple rule: when I can achieve my target profit margin, I sell without looking back at future price movements.”

Edward’s example refers to selling gold he had purchased as an investment. A seller may not be thinking about margins when selling inherited jewelry, but the practice still applies. Sellers should know the original purchase price of their gold and determine the minimum amount needed before looking to sell.

A person should research the value of their gold and determine a realistic sale price. Know the amount needed and the number below which to walk away from the deal.

When You’re Ready to Sell Your Gold

Selling gold can be an emotional experience, especially when it’s tied to someone loved or a significant chapter in your life. At The Alloy Market, we never treat it like “just another transaction.” We listen, guide, and honor the story behind each piece.

When new to selling, it’s normal to feel unsure. That’s why we’ve made the process simple and pressure-free. From free insured shipping to clear, honest offers, our goal is to help you feel confident at every step.

When you’re ready, request your free, no-obligation Alloy appraisal kit. You’ll receive expert guidance, complete transparency, and the Alloy Market’s highest payout guarantee. No pressure. Just real value on your terms.