How Much Gold Can I Sell Without Reporting to the IRS?

Disclaimer: This material is provided for informational purposes only and does not constitute financial, investment, legal, or tax advice. The information contained herein is general in nature and may not apply to your specific circumstances. You should consult your own financial advisor, tax professional, or accountant before making any financial or tax-related decisions.

Selling gold may be simple, but how does it get reported? Maybe not. You may be wondering, “How much gold can I sell without reporting it to the IRS?” The rules don’t apply equally to everyone: in most cases, the dealer handles specific paperwork, but even you, as the seller, still have reporting obligations that must not be overlooked.

In this guide, we explain which sales are subject to reporting (and which ones are not) and what each party is required to do.

In a nutshell

There isn’t a fixed amount of gold you can sell without any tax reporting; the requirement is tied to whether you realize a profit and IRS reporting rules, not simply how much you sell. The IRS treats gold as a capital asset, so if you sell gold for more than you paid, that gain generally needs to be reported on your tax return, even if the sale isn’t large. Dealers may file IRS forms like Form 1099-B when certain types or quantities of gold are sold, and Form 8300 if they receive more than $10,000 in cash in a single or related transaction, but your obligation to report gains remains separate. Understanding when and how to report helps you stay compliant and avoid penalties.

Why Does the IRS Care About Gold Sales?

The Internal Revenue Service (IRS) treats gold as a capital asset, which means any profits from selling it may be subject to capital gains tax. This includes coins, bars, and even certain forms of scrap gold.

Just like selling stock, when you sell gold at a profit, you’re expected to report that gain and pay taxes accordingly. The government views this not as a casual exchange, but as a taxable event, especially if the gold was held as an investment.

Capital gains from gold are taxed at a maximum rate of 28%, since the IRS categorizes physical gold as a collectible.

- If you held the gold for more than one year before selling, the 28% rate applies to your gain.

- If you held it for less than a year, any profit is considered a short-term capital gain and is taxed at your ordinary income tax rate, which can range from 10% to 37%, depending on your income bracket.

How Much Gold Can I Sell Without Reporting – When Do I Need to Report Gold Sales?

When we talk about “reporting” gold sales, there are two sides to consider: your own obligation as the seller, and the dealer’s obligation to the IRS.

Gold seller responsibilities

Whether you sold one coin or a full stack, if it results in a profit (i.e., you sold the gold for more than you originally paid), you incur a capital gain.

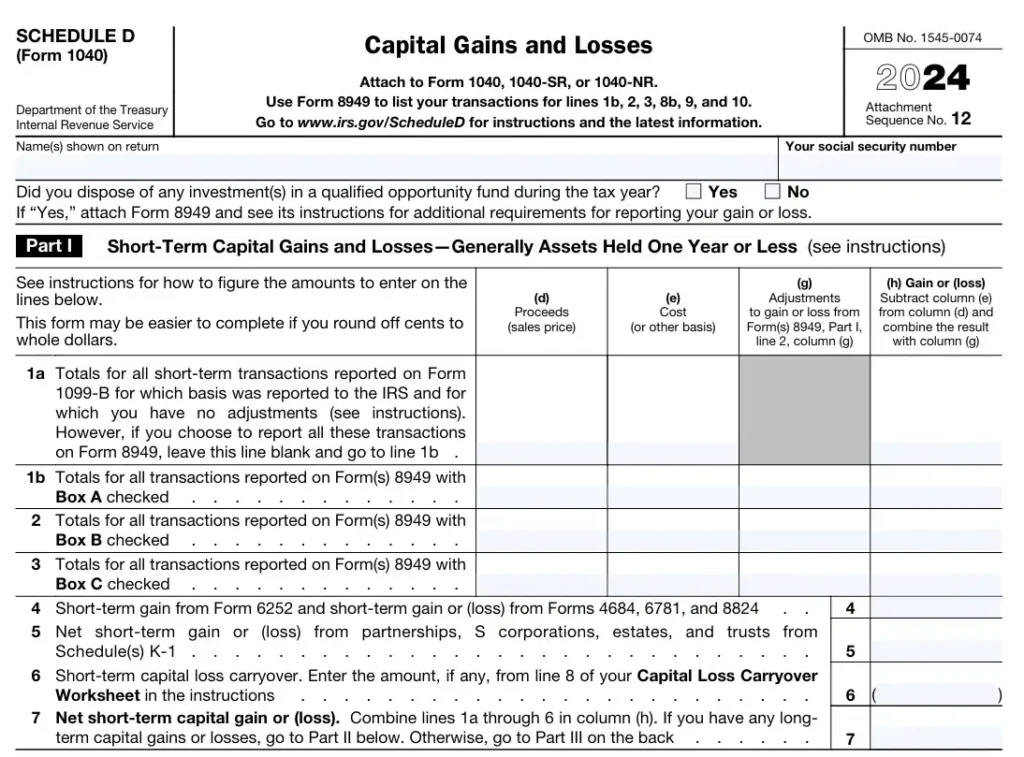

You may be required to report those gold sales on your federal income tax return, specifically on Schedule D (Form 1040), which is used to declare capital gains and losses from investment assets like gold. That said, there are a few exceptions where reporting may not be applicable, and we’ll cover those in the sections ahead.

Now, it’s worth noting what many individuals attempt to do: avoid reporting altogether by selling under the radar – in small batches, to private parties, or without keeping documentation of their original purchase price.

But this strategy is risky. If the IRS audits your return or sees a mismatch in what’s reported elsewhere (say, from a business or broker who did file something), you could face back taxes, penalties, or even criminal charges.

That brings us to the other side of the equation: How reporting works on the dealer’s end.

Gold dealer responsibilities

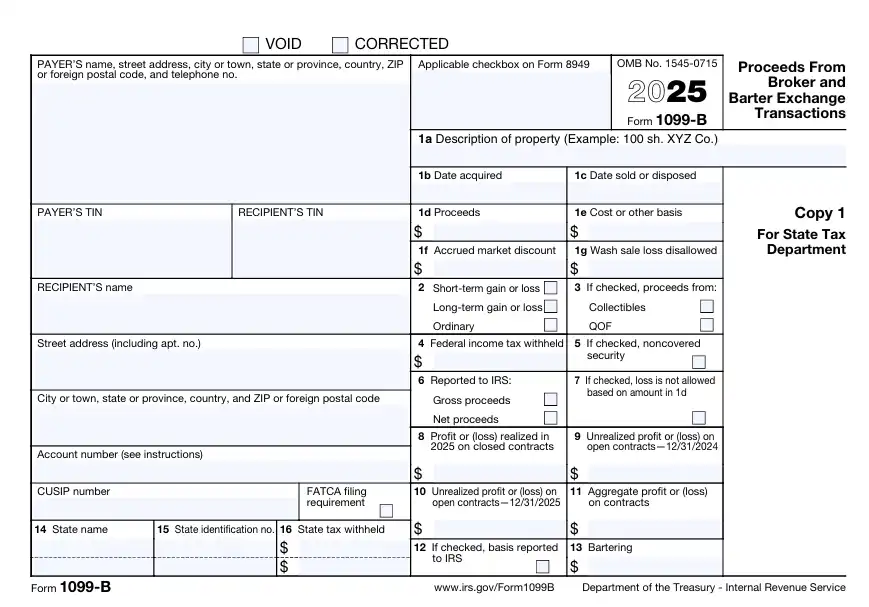

Form 1099-B

Dealers must report your gold sale to the IRS using Form 1099-B if certain conditions are met.

For context, Form 1099-B is used to report proceeds from broker or barter exchanges, including the sale of precious metals in certain situations. It serves as a third-party record that helps the IRS verify if sellers are correctly reporting capital gains on their tax returns. This raises the stakes for accuracy and transparency.

Now, going back to “conditions” mentioned earlier, whether your gold dealer must file a Form 1099-B depends mainly on two things: The type of gold and the quantity sold. We’ll break down the exact thresholds shortly.

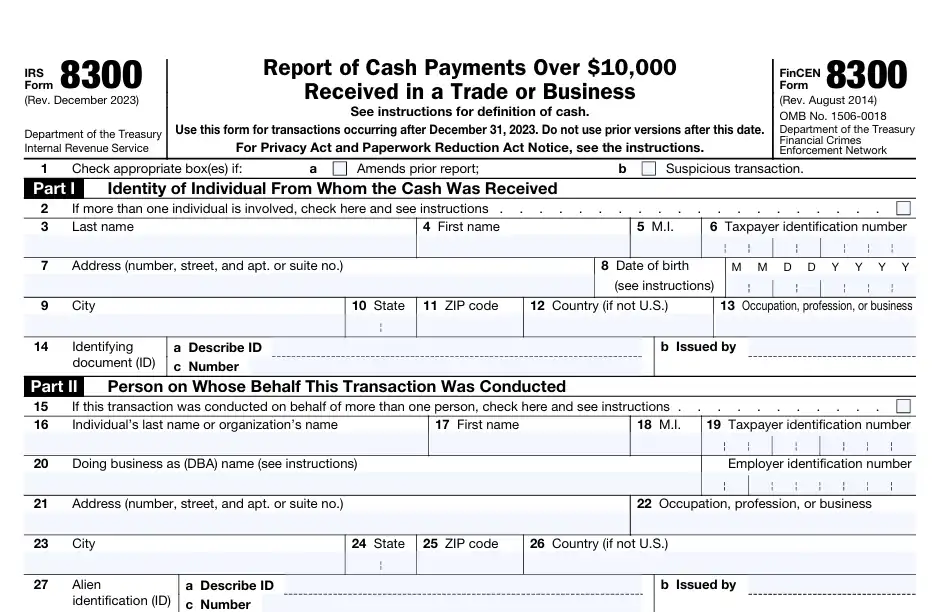

Form 8300

Dealers are required to file Form 8300 when they receive more than $10,000 in cash as part of a single transaction or a series of related transactions. For reporting purposes, these related transactions generally fall into two categories:

- Transactions occurring within a 24-hour period

For example, if a customer makes two cash payments of $6,000 each within the same day, these are considered related transactions totaling $12,000 and must be reported.

- Transactions that are connected or part of a single agreement

For example, if a customer agrees to purchase $15,000 worth of gold, paying $7,500 in cash today and $7,500 the following week, the dealer is still required to file Form 8300 once the total cash received exceeds $10,000, even though the payments occur on different days.

Dealers must submit Form 8300 within 15 days of receiving the payment that causes the total cash amount to exceed the reporting threshold.

Form 8300 exists to help prevent money laundering and large untraceable cash movements. It is separate from capital gains reporting and does not determine whether a seller owes taxes on a gold sale.

If a dealer requests identification or additional information during a significant cash transaction, this is a standard compliance requirement across many industries, including precious metals, automotive sales, and jewelry. In the event of an audit, this reporting also creates a documented record showing that the transaction was handled correctly and disclosed.

Common Misconceptions About Selling Gold Without Reporting

There is a lot of confusion around how gold sales are reported and what triggers IRS disclosure. Some of the most common misconceptions include:

“If I don’t receive a tax form, the sale isn’t reported.”

This is not necessarily true. Certain gold sales do not require a 1099-B, but that does not automatically mean the transaction is unreported or that taxes do not apply. Tax obligations are determined by capital gains rules, not solely by whether a form is issued.

“Selling smaller amounts always avoids reporting.”

Reporting requirements depend on the type of gold being sold, how payment is received, and whether transactions are related. Multiple smaller payments connected to a single agreement can still trigger reporting requirements.

“Private or local sales don’t count.”

Even when selling to a private buyer or local dealer, tax rules may still apply. The responsibility to report taxable income ultimately rests with the seller, regardless of where or how the sale takes place.

“Only businesses are responsible for reporting.”

While dealers have specific reporting obligations, individuals are still responsible for reporting taxable gains on their personal tax returns when applicable. Reporting requirements for businesses and tax obligations for individuals are separate considerations.

Alloy wants to buy your gold

Request a free Alloy Kit, ship from home, and receive a same-day offer after evaluation.

Alloy wants to buy your gold

Request a free Alloy Kit, ship from home, and receive a same-day offer after evaluation.

What Types of Gold Require Reporting (Form 1099-B)?

As mentioned earlier, not all gold sales are reported to the IRS by dealers – but certain transactions must be, depending on the type of gold and the quantity sold.

Once those thresholds are met, the dealer is required to file Form 1099-B.

Here’s a breakdown of everyday gold products that trigger 1099-B reporting when sold in quantities that meet or exceed the IRS-mandated minimums:

| Reportable Item | Minimum Fineness | Minimum Reportable Amount |

|---|---|---|

| Gold Bars | .995 | Any size bars totaling 1 kilo (32.15 troy oz.) or more |

| Gold 1 oz. Maple Leaf | As minted | 25 or more 1-oz. coins |

| Gold 1 oz. Krugerrand | As minted | 25 or more 1-oz. coins |

| Gold 1 oz. Mexican Onza | As minted | 25 or more 1-oz. coins |

The minimum reportable amount refers to the quantity of gold sold in a single transaction that triggers a dealer’s obligation to file Form 1099-B. However, it doesn’t always have to be one payment:

- If you sell to the same dealer multiple times within a 24-hour period, the IRS requires the dealer to aggregate those sales. And if the combined total meets or exceeds the threshold, it must be reported as a single transaction.

- Suppose the dealer has reason to believe that multiple transactions are related or prearranged. In that case, they must treat them as a single reportable event, even if they occur more than 24 hours apart.

For example, if a customer comes in to sell 15 coins and casually mentions they’ll return tomorrow to sell 10 more (for a total of 25 coins), that verbal cue may be enough for the dealer to reasonably conclude that the sales were split to avoid Form 1099-B. In that case, the dealer is required to file the form based on the combined total.

Whether or not the dealer files a 1099-B, your responsibility as a seller remains. If you sold your gold for more than you paid, you must report the gain on your tax return. There’s no “workaround” for that.

What Types of Gold Sales Are Not Reportable (by Dealers)?

Here are three common examples of gold sales that do not require dealers to file Form 1099-B:

Sales of gold coins not on the reportable list

If you’re selling popular coins like the American Gold Eagle, the American Buffalo, or even fractional gold coins (e.g., 1/10 oz Maple Leafs) – items that fall outside the IRS-approved reportable list – your sales typically don’t trigger Form 1099-B reporting.

Small sales below the reporting thresholds

If you sell gold coins or bars in amounts below the IRS thresholds (e.g., fewer than 25 Gold Maple Leafs, or less than 1 kilo in bars), the dealer is not required to submit a 1099-B. Although, do remember the rule on single transactions earlier, where sales made within 24 hours or deemed related may still be aggregated and reported.

Personal jewelry

Selling personal items like gold wedding bands, broken necklaces, or scrap gold (from old watches, for instance) does not require dealer reporting. These items are considered used consumer goods, not investment-grade bullion.

Private sales (peer to peer)

Suppose you sell gold directly to another person, such as a friend, family member, or someone you connected with through a local ad. In that case, the transaction isn’t subject to IRS reporting rules – simply because no registered dealer is involved.

Do you sell to a registered dealer?

└── Yes → Is it investment-grade gold (coin/bar)?

└── Yes → Does the sale meet IRS quantity thresholds?

└── Yes → Reportable (Form 1099-B)

└── No → Not reportable

└── No → Not reportable

└── No → Private sale — not dealer reported (but you must self-report any gain)

IRS Reporting Rules for Cash Transactions (Form 8300)

Dealers who are paid more than $10,000 in cash (either in one go or through related transactions) are legally required to file Form 8300. As mentioned earlier, this form focuses on preventing money laundering and large, untraceable cash movements, rather than capital gains.

Side note: Chances are, you’re like many others who aren’t registered dealers and only sell gold once or twice (maybe from a gift), so this likely doesn’t apply to you. But if selling becomes a regular source of income rather than a one-time cash-in, you could cross into what the IRS considers “being in the business”, at which point, you’re legally required to file Form 8300 yourself.

The definition of “cash” here is broader than what most people assume. It includes not only physical bills but also cash equivalents, namely:

- Cashier’s checks

- Bank drafts

- Money orders

- Traveler’s checks

So what counts (and what doesn’t) as a trigger for Form 8300? We’ve broken it down in the table below:

| Payment Type | Reportable by Dealer? | Form 8300 Required? |

|---|---|---|

| Physical U.S. cash ≥ $10,000 | Yes. Always reportable above threshold | Yes |

| Two or more cash equivalents (under $10K individually) ≥ $10,000 combined | Yes. Treated as “structured cash” if related | Yes |

| Single cash equivalent ≥ $10,000 | No. Bank handles reporting | No |

| Bank wire, ACH, Zelle, etc. | No. These are traceable non-cash payments | No |

Legal Ways to Minimize Reporting and Taxes When Selling Gold

There are several practical ways gold sellers can stay compliant while managing taxes and paperwork more efficiently. That being said, this is not intended as tax or legal advice. You should always consult a qualified tax advisor to evaluate your specific situation.

- Hold long-term for better tax treatment. If you hold physical gold for more than one year before selling, your profits may qualify for the lower 28% collectibles rate. Otherwise, gains from short-term holdings may be taxed at your regular income tax rate, which could be higher if you’re in a middle or upper income bracket.

- Sell gradually to stay below dealer reporting thresholds. For example, instead of selling 30 Gold Maple Leafs at once, you might sell fewer than 25 in a single transaction to avoid triggering Form 1099-B. However, do remember that the IRS aggregates sales within a 24-hour period.

- Sell to non-reporting buyers such as local jewelers or individual collectors. Again, this doesn’t exempt you from taxes, but it does give you more discretion and, in a sense, lower visibility to the IRS.

- Keep clear records of when, how, and for how much you acquired your gold. This establishes your cost basis, which is key to determining whether you made a profit or loss when you sell, and how much tax you actually owe.

How to Report Gold Sales on Your Taxes

To report your gold sales to the IRS, use Schedule D (Form 1040). This is the official form used to declare capital gains and losses from investment assets, including physical gold.

As we mentioned earlier, because gold is classified as a collectible, your long-term gains (assets held for more than one year) may be taxed at a rate of up to 28%. If you sold at a loss, however, you can use that loss to offset gains from other investments.

For complex tax situations, consult a qualified tax advisor to ensure 100% compliance.

Sanctions When Gold Sales Are Not Reported

Seller sanctions

If you don’t report a taxable gain from your gold sale, the IRS can hit you with back taxes, interest, and penalties.

The IRS charges a penalty for various reasons, including if you don’t:

- File your tax return on time

- Pay any tax you owe on time and in the right way

- Prepare and file an accurate return

- Provide accurate and timely filed information returns

If the IRS believes your omission was intentional, you could face a civil fraud penalty or worse, criminal charges

Dealer sanctions

Dealers who fail to file the required Form 1099-B information returns may face penalties. As of 2025, the penalty amounts below apply to each information return that is filed late:

- Filed within 30 days after the due date: $60 per return

- Filed more than 30 days late but before August 1: $130 per return

- Filed on or after August 1 or not filed at all: $330 per return

- Intentional disregard of filing requirements: $660 per return

For more details, you can refer to the IRS guidelines on Information Return Penalties.

For penalties specific to Form 8300, the penalties are:

- $310 per return for negligent failure to timely file or include all required information.

- For intentional disregard, the penalty is the greater of $31,520 or the amount of cash received in the transaction, not to exceed $126,000 per transaction.

Common Misconceptions About Reporting Gold Sales

Throughout this guide, we’ve touched on myths and half-truths that often circulate in forums and casual conversations. Let’s address some of the most common ones directly:

Misconception 1: “I don’t get a 1099, so I don’t owe taxes.”

Regardless of whether a dealer files Form 1099 B or not, individuals are still legally required to self-report capital gains. Failure to report can result in penalties, back taxes, and interest if discovered later in an audit.

Misconception 2: “I can sell to avoid taxes if I keep it under $10,000.”

This is a typical mix-up between reporting thresholds and tax liability. The $10,000 threshold applies to cash transaction reporting (Form 8300), not capital gains. You could sell $5,000 worth of gold, receive no 1099, and still owe taxes if you made a profit. The bottom line is this: The amount doesn’t matter – the gain does.

Misconception 3: “All gold sales are reportable.”

Dealers only file Form 1099-B for specific products sold in particular quantities. Refer to our earlier discussion on “Types of Gold Sales That Are Not Reportable.”

Misconception 4: “If I inherit gold, I’ll owe taxes right away.”

Inheriting gold is not a taxable event by itself. The key tax implication comes when you sell it. And thanks to the step-up in basis, your gain (and potential tax owed) is calculated based on the gold’s market value at the time of the original owner’s death, not what they paid for it.

Disclaimer: This material is provided for informational purposes only and does not constitute financial, investment, legal, or tax advice. The information contained herein is general in nature and may not apply to your specific circumstances. You should consult your own financial advisor, tax professional, or accountant before making any financial or tax-related decisions.

Have gold to sell?

Request a free Alloy Kit, ship from home, and receive a same-day offer after evaluation.

Have gold to sell?

Request a free Alloy Kit, ship from home, and receive a same-day offer after evaluation.