Can You Sell Gold to a Bank?

Have you ever wondered, “Can you sell gold to a bank?” It’s a common question. People with gold coins, bars, or even jewelry sitting around the house, in particular, want to know. Especially when looking to sell those items.

The truth is, most banks in the U.S. don’t buy gold directly from customers. That can be surprising, since banks feel like the most “official” place to go.

But here’s the good news: there are plenty of options that often pay more, move faster, and come with fewer headaches.

This article examines the types of gold that banks might buy, discusses selling options, and provides guidance on obtaining the best gold price.

In a nutshell:

Most U.S. banks don’t buy gold from the public. Sellers usually receive better offers from reputable online gold buyers or local coin dealers. Higher payouts are especially true for bullion, jewelry, and popular coins.

Do Banks Buy Gold?

Most U.S. retail banks do not purchase gold directly from customers. Some banks or bank-affiliated bullion desks might accept gold bars or coins. For these institutions, buying gold helps diversify their asset holdings. It also enables them to offer their high-net-worth clients additional investment options. However, it’s essential to understand that any bank that does buy gold has specific conditions for these transactions.

What Types of Gold Will Banks Buy?

Not all gold is treated equally. Banks and other buyers value bullion and coins differently from jewelry.

Gold bullion and gold bars

Gold bars are among the most trusted forms of gold. If they have an official stamp or an assay certificate, it makes it very easy for banks to price. These features ensure banks can quickly verify the weight and purity.

When selling gold bullion to a bank, the bank will typically price it below the market (spot) price. Doing so allows the bank to cover its cost of authenticating the gold, especially if an assay certificate is not available.

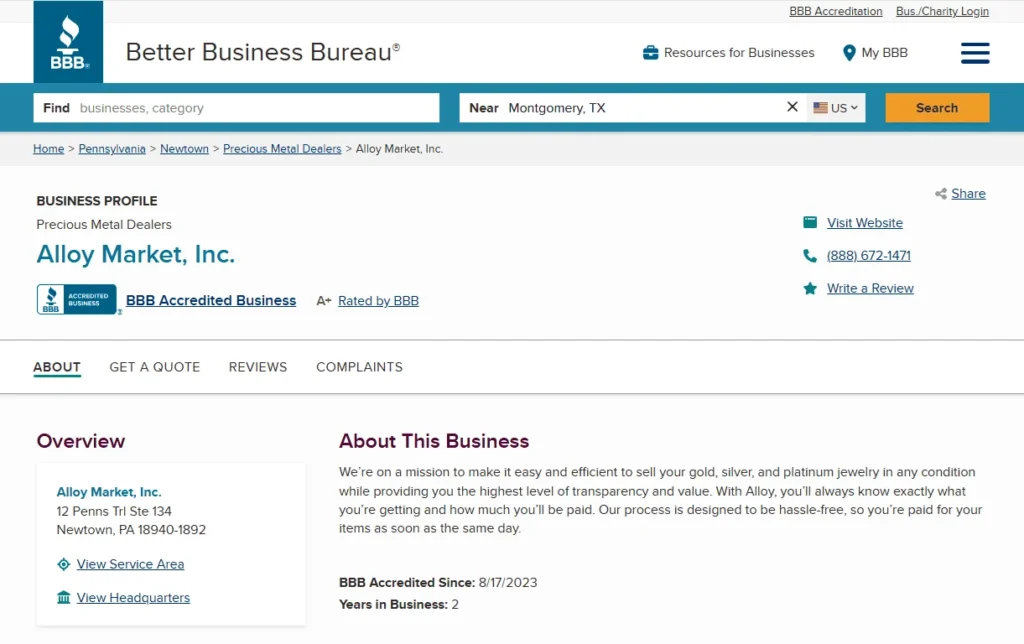

If a local bank is willing to buy gold bars, be aware that the price they offer will be less than what one would receive from an online buyer, such as Alloy. We specialize in buying gold and other precious metals. Each day, we handle large volumes while still offering industry-leading payouts.

Gold coins

Coins from well-known mints are highly desirable. The United States Mint’s American Gold Eagle and the Royal Canadian Mint’s Canadian Maple Leaf are top contenders. They are widely recognized, hard to fake, and easy to resell. As a result, they often bring in stronger offers compared to jewelry.

Typically, coin dealers will value gold coins based on their collectability and purity. However, when selling gold coins to a bank, they will focus primarily on the coins’ melt value.

Gold jewelry

Banks typically don’t buy gold jewelry because it’s not as easy to sell as bullion and coins. Additionally, banks do not practice verifying the authenticity of gold. To purchase gold, they would need proper documentation and certification.

What Are Alternative Options for Selling Gold?

Since most banks aren’t in the business of buying gold, sellers need to explore other options. Fortunately, numerous places are willing to buy gold, whether it’s in the form of bullion, coins, or jewelry. Each option will have its pros and cons, so it’s best to compare them before making a decision.

Selling to online gold buyers

Many reputable buyers offer free, insured shipping, providing a way to send gold safely for appraisal. Online gold buyers, such as Alloy, are a popular choice because they offer some of the highest payouts.

Plus, when the seller accepts the offer, payments are usually made within a few days. Alloy goes a step further by authorizing payment the same day the offer is accepted.

When using an online gold buyer, choose a company with a proven track record of positive reviews. Review their reputation for trust within the industry. Doing so helps avoid falling victim to scams.

Selling to local coin dealers

Coin dealers are convenient for those who want to sell gold coins and receive cash on the same day. These buyers have experience in buying coins and bars. However, offers can vary from one dealer to another. It’s smart to visit more than one to compare prices before making a sale.

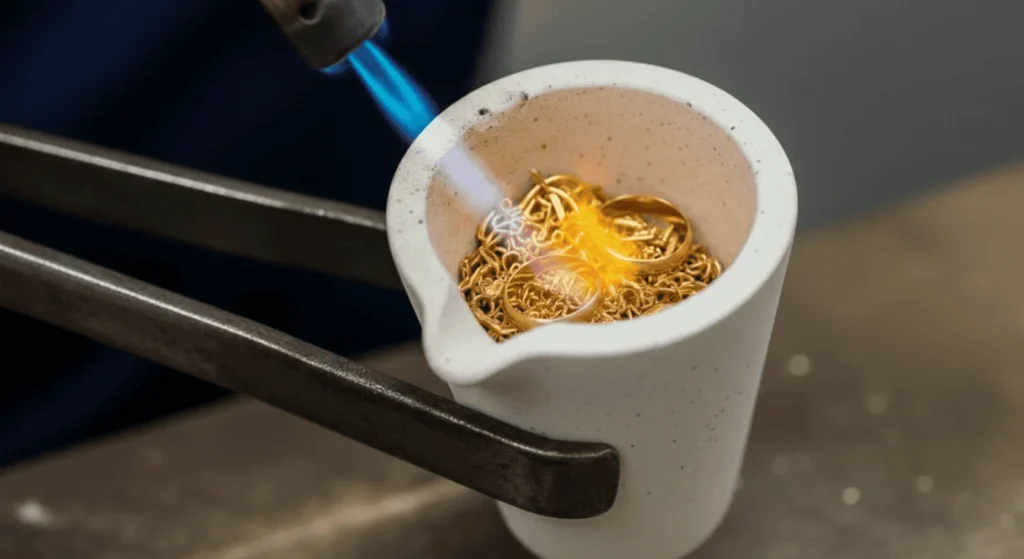

Selling to jewelry stores or refiners

Some jewelry stores and refiners will buy gold from the general public. Refiners focus on the gold’s purity and weight because they will melt the gold down. When selling larger quantities, the process can be lengthy. However, they may be more apt to offer competitive prices in this situation.

Selling to pawn shops

Pawn shops buy gold quickly, but they usually pay the least. They’re best only if someone needs fast cash and doesn’t mind getting a lower payout. For most people, other options are better.

How Do I Get The Best Price When Selling Gold?

A seller looking to receive the best possible price when selling gold needs to prepare. Buyers base their offer on several factors, including purity, weight, and the current market price.

By understanding the value of their piece, one can avoid being taken advantage of. Here are a few tips to help receive the best offer.

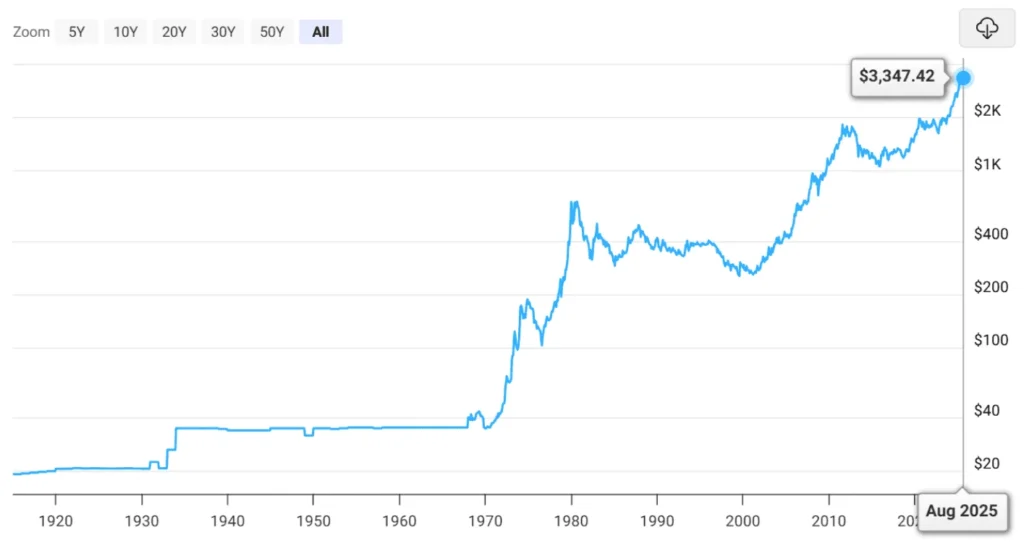

Understanding the spot price of gold

The spot price is the current market value of gold. Just like a company’s stock price can fluctuate throughout the day, the price of gold can also move up and down. No buyer will buy gold for the full spot price. However, knowing the current price will help to understand if the purchase offer is fair.

Know your gold’s purity

Understanding the type of gold making up a piece can help determine its value. 24-karat gold is purer and has a higher value than 14-karat gold. Below is a chart to help understand purity levels.

| Marking | Karat (K) | Gold Content (%) |

Description |

|---|---|---|---|

| 999 | 24K | 99.9% | Pure gold, often used in bullion or high-value jewelry. |

| 916 | 22K | 91.6% | Common in traditional jewelry, especially in India and Asia. |

| 750 | 18K | 75.0% | Widely used in fine jewelry, a good balance of purity and durability. |

| 585 | 14K | 58.5% | Durable and affordable, popular in the United States for everyday jewelry. |

| 417 | 10K | 41.7% | The minimum standard for gold in many countries, highly durable. |

| 375 | 9K | 37.5% | Common in vintage and lower-cost jewelry, especially in Europe. |

Compare offers from multiple buyers

When preparing to make a large purchase, buyers generally shop around to find the best deal. Individuals should do the same when selling gold. Get offers from multiple buyers to compare and receive the best possible deal. One thing that sets Alloy apart is that we guarantee the highest payout of any online or in-store gold buyer. Sellers feel confident that they’re putting as much cash in their pockets as possible.

Avoid pawn shops

Pawn shops are in business to help people get quick cash. Unfortunately, access to that cash usually comes at a cost. Selling gold to pawn shops is almost always likely to result in the lowest price. Unless someone is in a bind and needs quick cash, it’s best to avoid pawn shops.

Keep it clean

When preparing to sell gold, appearance matters. Before shipping it to an online gold buyer or taking it to a local buyer, make sure it’s clean. Gold that appears well-maintained has a better chance of fetching the highest cash value.

However, it’s important to use approved cleaners when cleaning gold jewelry. Avoid harsh chemicals, as they can damage the metals.

Sell Your Gold to Alloy

The Alloy Market wants to become your preferred gold buyer. Our process is transparent, and we aim to make it as seamless and stress-free as possible. Use our calculator below to calculate the estimated value of your item.

Gold Melt Value Calculator

Current Market Value:

$0.00

Average Pawn Shop Offer:

$0.00

Alloy’s Minimum Offer:

$0.00

When you’re ready, request a free Appraisal Kit. We’ll ship it out to you right away. Package your valuables in the provided parcel, and we’ll cover the shipping and insurance back to us. Tracking will be provided so you know where your items are at each step of the way.

Once we receive your items, we will test them for purity with our state-of-the-art testing tools. We will weigh them and calculate our offer for your review. When you accept your offer, we initiate payment that same day. If you don’t accept the offer, we will ship your valuables back to you at no cost.

Give Alloy a shot. We guarantee the highest payout in the industry. Your happiness is our primary goal.