How to Sell Gold Bars Online

People buy groceries online. They order medicine online. Some even do job interviews online. If someone has a gold bar sitting at home, or they’re planning to cash out on one soon, they can now sell it entirely online as well, without ever leaving their house.

Thanks to a growing number of online gold buyers, learning how to sell gold bars online has never been easier. Whether someone is a first-time seller, unsure of where to start, or seeking a better deal, this guide will explore the best options available.

In a nutshell

Selling gold bars online has never been easier. There are numerous options for selling, including mail-in evaluation platforms like The Alloy Market, peer-to-peer platforms, and bullion buyers. Sellers need to understand pricing and consider fees as well as safety when selecting a gold buyer for their bullion.

Where to Sell Gold Bars Online?

The most important thing to consider when selling is who the buyer is. The type of buyer someone chooses directly impacts how much they’ll receive, how quickly they’ll receive it, and how secure the process will be.

Mail-in evaluation platforms

Mail-in gold buyers (like The Alloy Market) specialize in physical evaluations. Sellers request a free, insured evaluation kit, ship their gold bar, and the buyers evaluate it in-house. Once assessed, sellers receive a no-obligation offer that they can either accept or decline.

Payouts on mail-in platforms can reach some of the highest compared to other online options. That’s because most handle operations entirely in-house, eliminating multiple middlemen and passing more of the gold’s value back to the seller.

Online bullion dealers

Online bullion dealers are professional precious metals retailers that also buy back investment-grade products, including coins, rounds, and gold bars.

The process is straightforward: sellers select a specific product from their buyback inventory, they lock in the offer price upfront, typically based on the live spot price (minus a small spread), and then sellers ship the item for verification. Once confirmed, they get paid.

Again, these platforms prioritize standardized, investment-grade bullion. They’re not interested in scrap or decorative gold. Everything needs to match the exact SKU (Stock Keeping Unit), weight, and condition. But in return, they offer some of the most competitive pricing available.

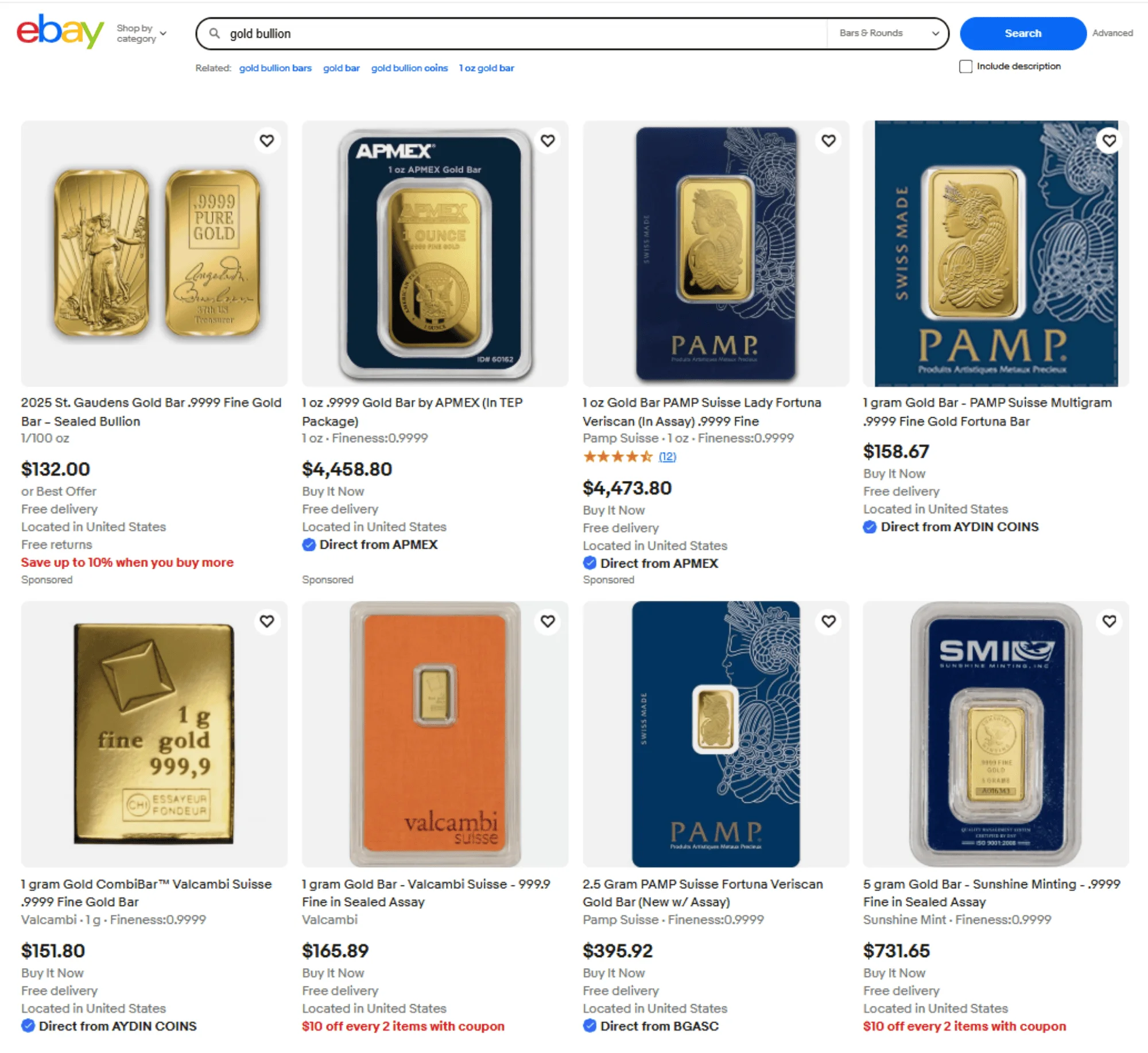

Auction or consignment sites

Auction or consignment sites allow sellers to list their gold bars and wait for buyers to bid (auction) or for the platform to sell them on their behalf (consignment).

Sites like eBay, WorthPoint, or 1stDibs are popular options for this setup.

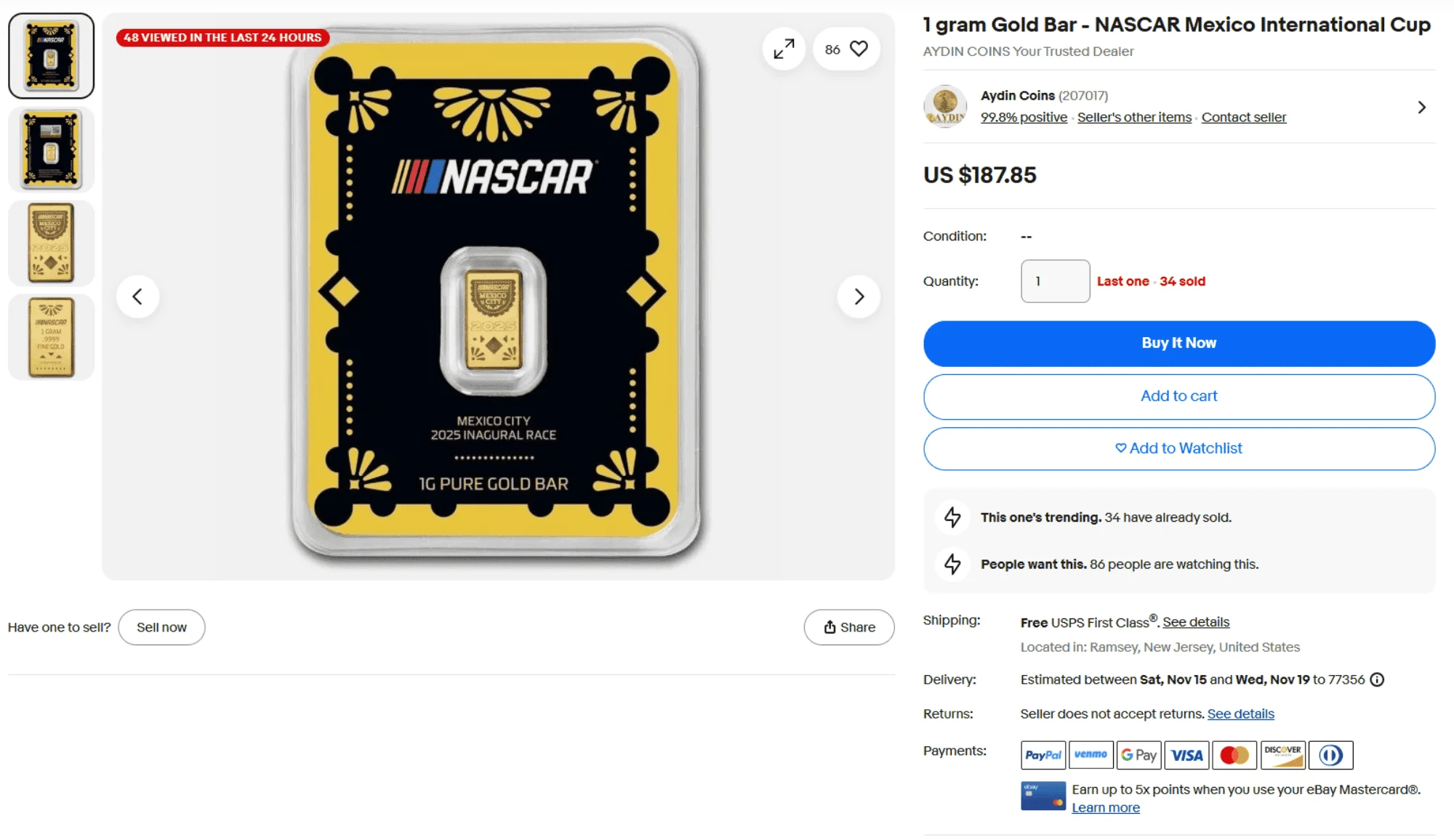

Technically, anyone can sell a gold bar on these platforms. However, keep in mind that they primarily cater to retail buyers seeking jewelry, collectibles, or branded luxury pieces, rather than investment bullion.

For example, a 10-oz gold bar, although valuable, doesn’t align with the audience’s typical buying behavior. It lacks the artistic or brand “display” value and the giftability that jewelry or coins often have. People may be looking more for collectible, artistic gold bars instead.

It’s also worth noting that most buyers on these sites lack the tools or expertise to verify the authenticity of bullion.

All this to say, auction or consignment platforms are best suited for rare, branded, or collectible jewelry pieces. For someone selling bullion, they’ll likely get better payouts through mail-in buyers or specialized bullion dealers.

Peer-to-peer platforms

Think Craigslist, Reddit, or private gold forums. (Facebook does not allow “cash equivalent” sales on its platform.) These platforms enable sellers to connect directly with buyers, set their own prices, and manage payments and deliveries themselves. People have more freedom and control over the sales process, which also means they have the potential to earn closer to the spot price, especially if they can gain the buyer’s trust.

However, this flexibility comes with higher safety risks. Handling everything oneself leaves room for scams, counterfeit deals, or lowball offers. Unfortunately, these incidents occur more frequently than most expect in peer-to-peer setups.

How to Prepare Your Online Gold Bar Sale?

Unlike in-person transactions, online selling means sellers ship a bar to someone they’ve likely never met, which raises several questions about proof, trust, and communication.

Keep these points in mind to get everything in order:

- Verify the gold bar’s details: Know its exact weight, purity (karat or fineness), and brand. These are usually stamped directly on the bar. For bars without markings, include documentation or get a professional appraisal first.

- Check for serial numbers and packaging. Most investment-grade bars from reputable refineries, such as PAMP Suisse, Valcambi, or the Royal Canadian Mint, are accompanied by a serial number and an assay certificate. A sealed bar in its original packaging, mentioned clearly, can increase buyer trust.

- Gather any purchase receipts or documentation. Proof of purchase, vault storage records, or prior appraisals help establish authenticity and support pricing, especially for first-time sellers.

- Photograph the bar clearly. Take high-resolution photos in natural lighting showing the front, back, serial number, and any relevant markings. These types of photos protect sellers in the event of shipping damage or disputes that may arise later.

- Pre-check the buyer’s shipping requirements. Some online buyers may have particular packaging or label instructions. Check their website FAQs, or better yet, get in touch via email or phone to confirm, and avoid unnecessary delays or rejection.

- Understand how payouts work. Before mailing anything, know how and when the buyer will pay. Will they send a final offer after the testing is complete? Can that offer change? How soon will the funds arrive? It’s better to clarify these details now than tumble into panic later.

- Use insured, trackable shipping. When mailing a high-value item, always use the carrier and coverage level recommended by the buyer. Most reputable platforms will send a pre-insured mailer for peace of mind.

- Have a risk plan if selling peer-to-peer. Some additional notes on this matter:

- For sellers considering local meetups (e.g., through Craigslist or Facebook Marketplace), never go alone. Meet in a well-lit public place, and preferably near a police station. Avoid carrying large amounts of cash.

- If shipping, use a tracked method with signature confirmation, and only deal with verified buyers or those with a clear transaction history.

Steps to Sell Gold Bars Online

While some steps may vary slightly depending on the platform, the core process is usually the same:

- Choose a buyer. Based on what matters most to the seller (speed, payout, safety, or control), select a selling platform that aligns with those needs. Refer to the earlier comparison table to weigh all options.

- Request a quote: Often, this involves inputting a few details (e.g., weight, purity, item type) on the buyer’s website before receiving an offer.

- Ship your gold bar for confirmation: Online buyers typically provide a prepaid, insured, and trackable mailer. Ensure to follow the packaging instructions specified by the buyer.

- For mail-in evaluations, buyers often require sellers to ship their items first so they can provide a more accurate evaluation.

- For peer-to-peer or auction setups, buyers may request that sellers arrange the shipping themselves.

- Wait for verification or inspection: Once the gold bar arrives at the buyer’s facility, they inspect it for authenticity, weight, and condition. This process usually takes less than one day.

- Receive final offer: Depending on the platform, the payout may either match the original quote (if the gold checks out) or be adjusted based on actual purity or weight.

- Accept or reject the offer: Sellers have the option to accept or reject the final price. If they decline, their gold is returned, usually at no cost if the platform offers a no-obligation evaluation.

- Get paid: Once accepted, most online gold buyers pay via direct deposit, wire transfer, or check. Payment is typically released within 24–72 hours, although this timeframe may vary significantly for peer-to-peer transactions.

Considerations When Selling Gold Bars

Before selling gold bars online, it’s worth pausing to understand the key factors influencing gold bar prices and how each one can impact the final payout and the overall sales experience.

Types of gold bars

The type of gold bar someone has influences how much they’ll get, as well as how easily it’ll sell:

- Minted bars: These are precision-cut, sealed in tamper-proof packaging, and often carry higher resale appeal due to their cleaner finish and secure presentation. Standard bar sizes include 1g, 10g, 1 oz, and sizes up to 100g.

- Cast bars: These are equally pure as minted bars but with a rougher, overall look, which explains why they may be priced slightly lower on resale. These are typically available in larger sizes (100g, 250g, 1kg, or even 400 oz), making them ideal for institutional buyers or bulk investors.

Arguably, whether it’s a minted or cast bar, what really drives buyer trust and resale value is the refinery or mint that produced it.

Names like PAMP Suisse, Valcambi, Credit Suisse, and the Royal Canadian Mint are more trusted by buyers. If a bar carries one of these logos and a matching serial number, sellers are likely to receive a better offer than for an unbranded or obscure product.

Purity (karats)

Purity, expressed in karats, measures how much pure gold content is in a gold bar. Naturally, the higher the purity, the higher the value of the bar.

Pure gold is 24 karats, or 99.9% fine, and that’s the standard for most investment-grade gold bars. Well-known examples include the PAMP Suisse Fortuna, Valcambi 99.99% Fine Gold, Credit Suisse 1 oz bar, and the Royal Canadian Mint Maple Leaf bar.

By contrast, lower-purity bars, such as 22K (91.6%) sovereign-style or 90% vintage bullion bars, contain more base metals, like copper or silver.

While they’re still valuable, these alloys reduce the melt value and make such pieces less attractive to investors seeking the uniformity and liquidity of investment-grade gold.

Weight options

Gold bars typically come in weights such as:

- 1 gram

- 5 grams

- 10 grams

- 1 oz

- 50 grams

- 100 grams

- 250 grams

- 1 kilo (32.15 oz)

- 400 oz (London Good Delivery standard).

Each weight class affects how easily (and how much) one can sell, particularly in these three areas: liquidity, premiums, and logistics.

Liquidity

Liquidity refers to the ease and speed with which someone can convert their gold bar into cash without incurring a price loss. In general, smaller bars are more liquid. They’re easier to list, more affordable for the average buyer, and move faster in online marketplaces.

For example, 1 oz and 10g bars are commonly traded and highly in demand, especially among individual buyers.

On the other hand, larger bars, such as 1 kilo (32.15 oz) or 400 oz (London Good Delivery), are primarily sought after by institutions or serious investors. That narrower demand means a heavier bar might sit on the market for longer, or sellers might need to discount it to sell it quickly.

Premiums

A premium is the amount someone pays above the gold spot price when buying a bar. It covers manufacturing, distribution, dealer markups, and other related costs.

Smaller bars, such as 1 oz or 10 g, usually come with higher premiums per ounce because they’re more convenient and in higher demand. These premiums are also easier to recover when selling, as many buyers are willing to pay a bit extra for flexibility and ease of storage.

Larger bars, like 1 kilo or 400 oz, generally carry lower premiums per ounce. However, they can be harder to sell quickly.

Apart from being more expensive outright, large bars often require buyers to remelt or divide them into smaller units, which adds processing costs and reduces what they’re willing to pay upfront.

Logistics

Heavy bars cost more to ship, insure, and store. And if your bar isn’t sealed or is oddly packaged, it may raise suspicions during transit or inspection. All of this affects a seller’s net return, especially if the buyer subtracts those costs from the payout.

Regulations and taxes

The IRS treats physical gold bars as “collectibles.” That means any profit made when selling them is subject to capital gains tax, which can go as high as 28%.

To calculate the required tax, sellers will need to know their cost basis, which is basically what they paid for the bar (including shipping, premiums, or other related costs). The taxable gain is the difference between the amount received and the amount sold for.

Without proper records, that gain could be miscalculated, and sellers could end up having a bigger tax bill than necessary. Worse, if they’re audited and can’t substantiate their numbers, they may also face penalties or interest on top of that.

That said, taxes and reporting rules aren’t the most exciting part of selling gold, but overlooking them can cost. Check out the in-depth guide on How Much Gold Can I Sell Without Reporting for more details.

Gold spot price considerations

When selling gold bars, the spot price serves as the baseline. It’s what a bar is technically worth at that exact moment in the global market.

Spot prices fluctuate constantly, often responding to inflation reports, interest rate decisions, the strength of the U.S. dollar, geopolitical news, and central bank activity. Even within a single day, the value of a bar could shift by a few dollars per ounce.

To maximize the payout for a gold bar, always check the current gold spot price before listing or accepting any offer.

TradingView and similar platforms offer real-time charts that enable sellers to visualize where prices are trending. Knowing the spot price keeps people from selling too low and gives them leverage when negotiating with buyers.

That said, for someone selling a small amount, say a couple of 1-oz bars, they don’t need to obsess over timing the market perfectly. Gold prices have historically been on a general uptrend for years, and the differences in daily price swings are unlikely to impact the return significantly.

How to Sell Gold Bars Online with Alloy

The Alloy Market is quickly becoming a go-to for many gold sellers. Our selling process is straightforward and transparent, allowing you to sell your gold for the highest price from the comfort of your own home.

To get started, request a free, no-obligation Alloy Kit. It ships directly to your door and contains a pre-paid parcel to package your gold bars for shipping. We also cover tracking and insurance for your items so you know they’re safe.

Once your items arrive, our team tests them for purity and weight and sends you an offer for review. When you accept before 5 PM on a business day, payment is initiated the same day, with many customers seeing payments within 24 hours. If you choose not to accept our offer, we’ll ship your items back to you at no cost.