Is Gold Jewelry a Good Investment? A 25-Year Value Comparison Study

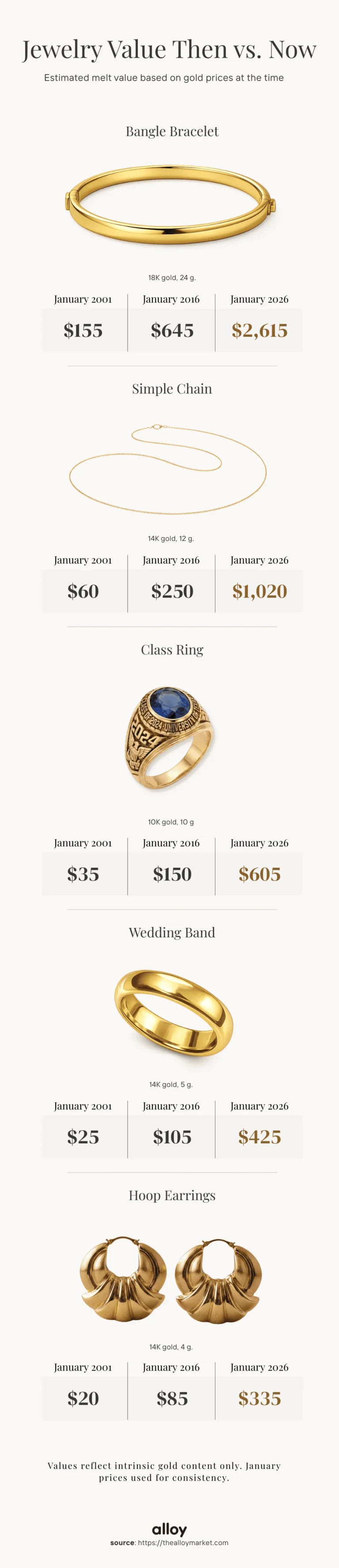

Key Findings

Everyday gold jewelry purchased 25 years ago now carries 10×–17× more intrinsic value, driven by higher gold prices. A basic 14K wedding band increased in value from about $25 in 2001 to roughly $425 today. Heavier, higher-karat pieces saw the largest gains, with some common gold bangles increasing by over 1,500%, now exceeding $2,600 in melt value.

Does Gold Jewelry Appreciate in Value?

When people purchase jewelry, it’s usually for sentimental reasons; to mark a milestone, celebrate a relationship, or commemorate a special moment. Rarely are people thinking about resale value at the time of purchase. Yet fine jewelry made from solid gold, even at the lowest karat, holds intrinsic value based on its gold content. It can retain financial value longer after sentiment has faded or a particular style no longer suits personal taste.

“Many consumers are surprised by how much their jewelry is worth. They often don’t realize how much value is retained through its precious metal content alone,” says Brandon Aversano, founder of The Alloy Market, a buyer of precious metals.

As gold prices continue to reach historic highs, many people are taking a second look at pieces that have sat untouched in jewelry boxes for years, wondering whether they might be worth anything today. In many cases, the answer is yes. Jewelry purchased a decade or more ago, when gold prices were a fraction of today’s levels, can have a much higher melt value today, driven by sustained increases in gold prices.

How Jewelry Value Is Being Measured

The melt value refers to the intrinsic value of the precious metal contained in a piece of jewelry, independent of design, brand, or resale markup. It is commonly used as a baseline for evaluating gold jewelry because it reflects the metal’s underlying market value. Actual transaction prices can vary based on fees, condition, and market factors, but melt value provides a consistent point of comparison.

Determining melt value relies on three core factors: the purity of the gold, the weight of the piece, and the current spot price of gold. Gold purity is measured in karats, with each karat indicating how many parts per 24 are pure gold. For example, a 14K piece has 14 parts of pure gold per 24, or approximately 58.3% purity. That purity percentage is then applied to the item’s weight and the current gold price to estimate its melt value.

For the comparisons that follow, melt value is used as a consistent measure of jewelry value across different time periods.

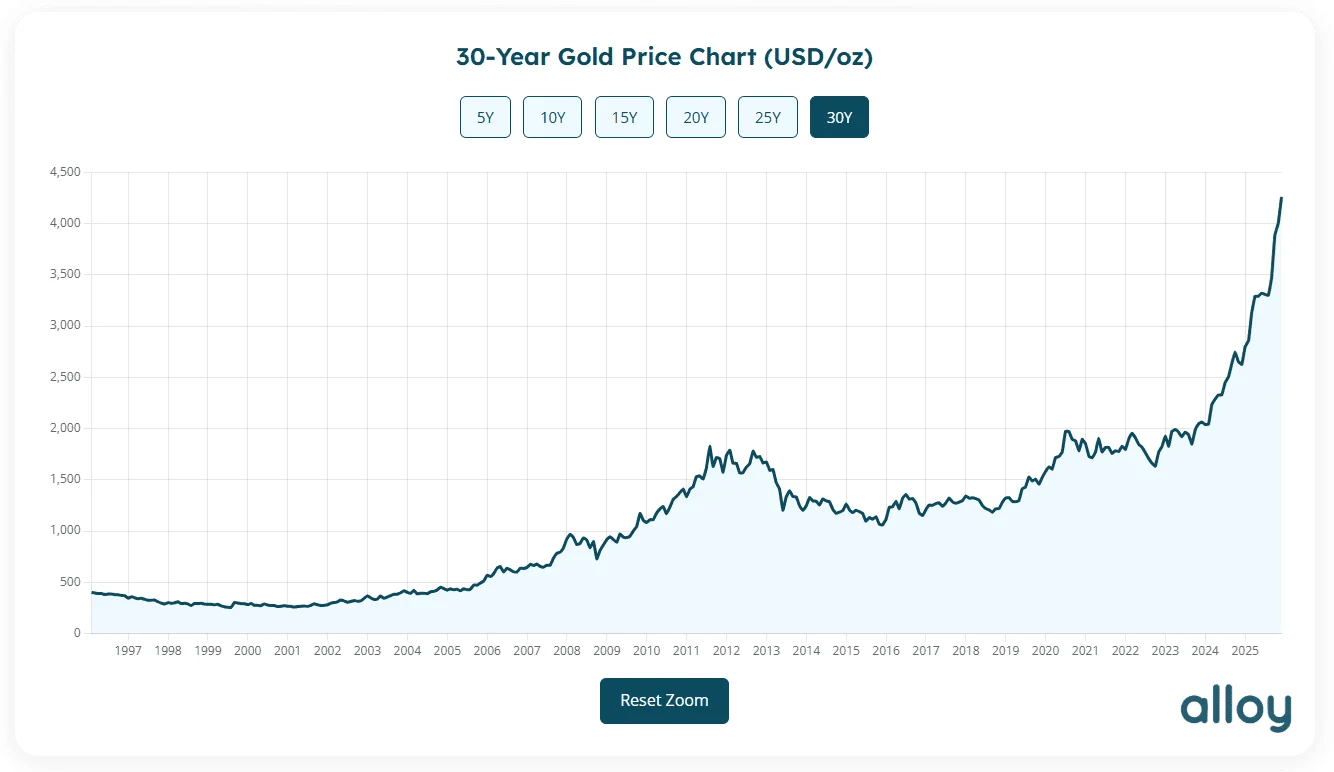

Snapshot: Gold Prices at Key Points in Time

To understand how jewelry value has changed, it helps to first look back at historical gold prices. Gold prices fluctuate over time in response to global demand, economic uncertainty, and currency movements. For this analysis, three points in time were selected to provide meaningful contrast without overcomplicating the comparison.

Approximately 25 years ago, gold prices were significantly lower than they are today, trading at roughly $270 per ounce in January 2001. At the time, gold was less prominent as a store of value than it would later become. During the early 2010s, prices rose sharply, reaching then-record levels around 2011 and 2012, when gold frequently traded above $1,500 per ounce, before stabilizing in the years that followed.

Ten years ago, however, prices were again on the rise. In early 2016, gold traded at just over $1,100 per ounce and continued to increase over the following years. While notable at the time, those price levels remain well below today’s market. In 2025, gold traded at historically high prices, far exceeding previous peaks and directly impacting the melt value of gold jewelry across all karat levels.

Together, these reference points provide a consistent basis for comparing the value of the same jewelry pieces across different periods as gold prices have changed.

Historical Analysis: Does Gold Jewelry Hold Its Value?

To illustrate how changes in gold prices over time translate into real-world value, the following examples examine several common types of gold jewelry using the same criteria at each point in time.

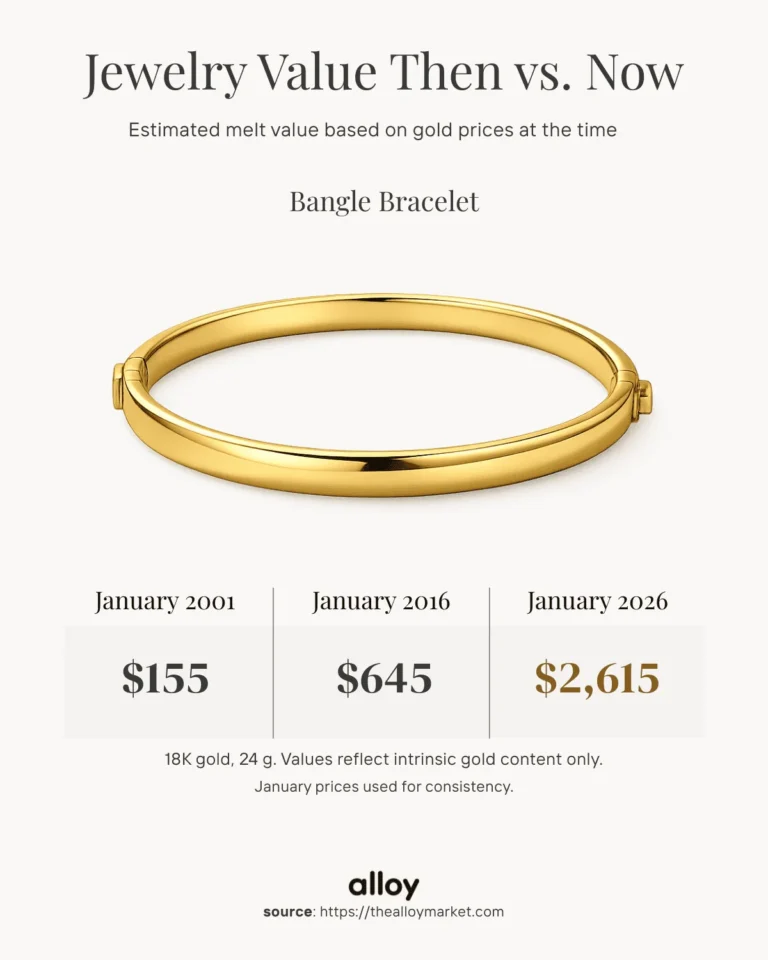

Gold bangle bracelet

The first example focuses on the melt value of an 18K gold bangle bracelet weighing approximately 24 grams. Because 18K gold contains a higher proportion of pure gold than lower-karat pieces below, its intrinsic value per gram is higher. In January 2001, when gold was trading at $266.20 per ounce, this bracelet would have had an estimated melt value of about $155. By January 2016, with gold trading at $1,116.40 per ounce, its melt value would have risen to roughly $645. Today, using a spot price of $4,512, that same gold bangle carries an estimated melt value of approximately $2,615.

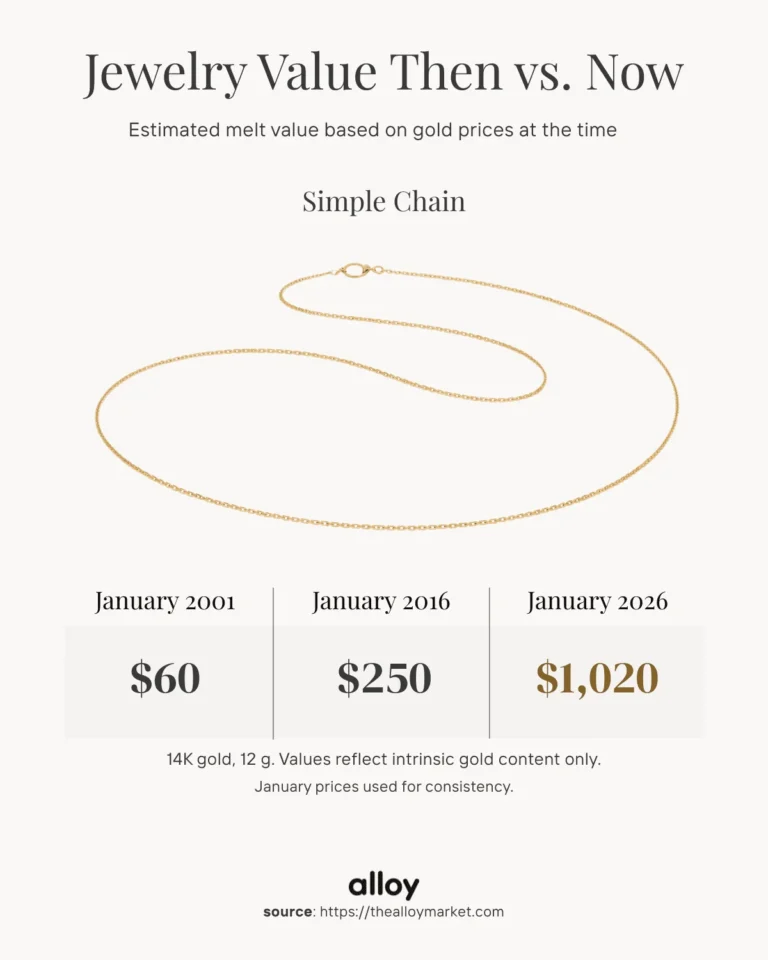

Gold chain

This example looks at the melt value of a 14K gold chain weighing approximately 12 grams. In January 2001, when gold was priced at $266.20 per ounce, the melt value of this chain would have been around $60. By January 2016, with gold trading at $1,116.40 per ounce, its estimated melt value had risen to roughly $250. Today, using a spot price of $4,512 per ounce, that same chain carries an estimated melt value of just over $1,000.

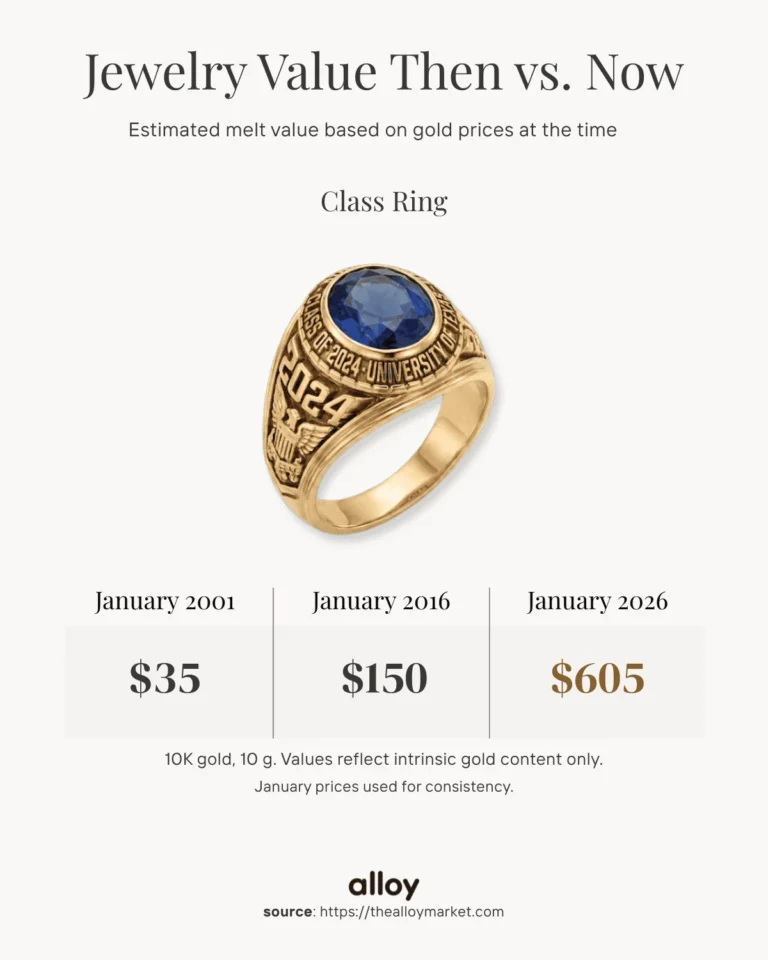

Class ring

The next example explores the melt value of a 10K class ring weighing approximately 10 grams, excluding the stone. This estimate reflects the gold content of the ring only. In January of 2001, when gold was priced at $266.20 per ounce, the melt value of this class ring would have been about $35. By January 2016, with gold trading at $1,116.40 per ounce, the estimated melt value had risen to roughly $150. Today, using a spot price of $4,512 per ounce, the same class ring carries an estimated melt value of around $605.

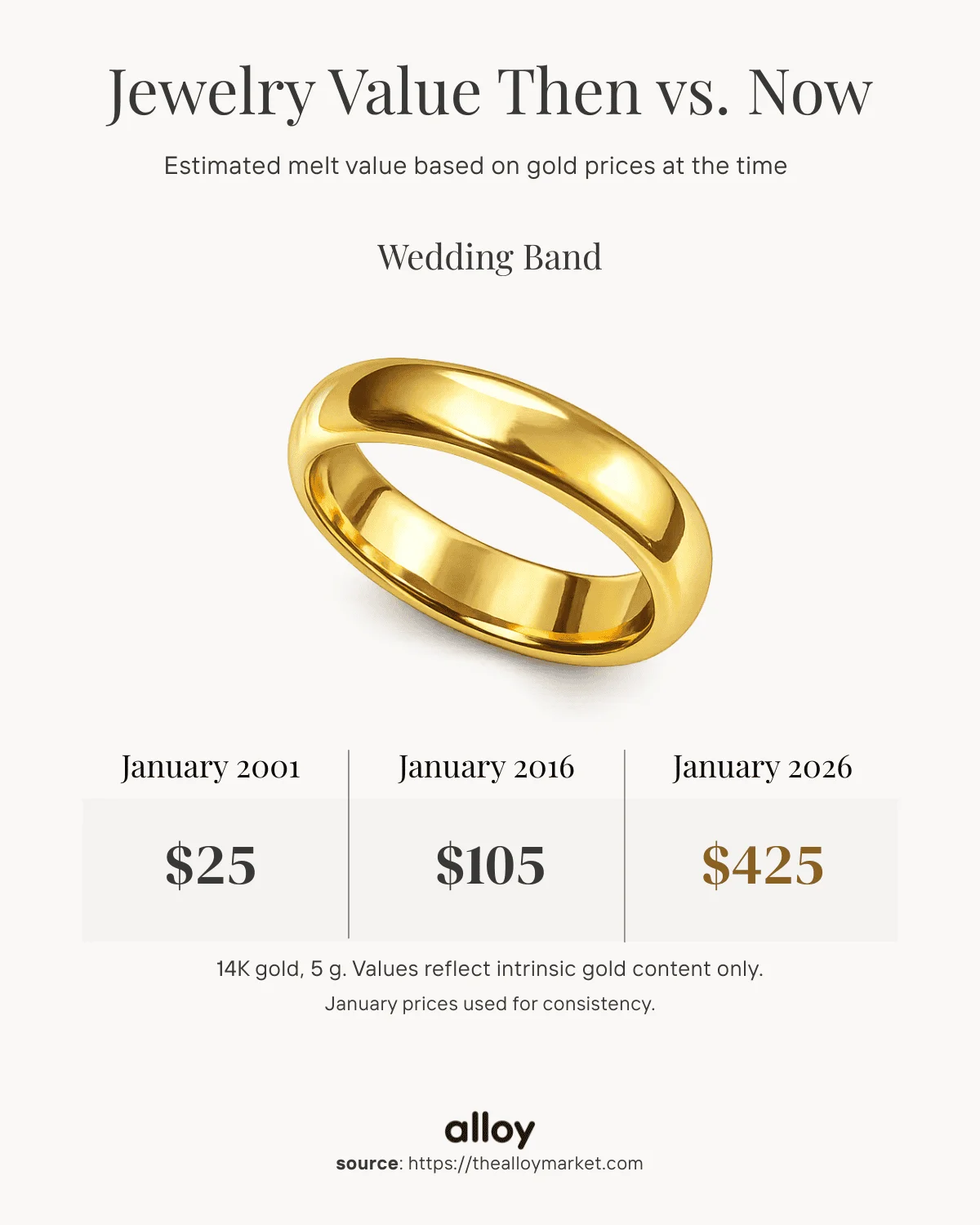

Gold wedding band

This example examines a 14K gold band weighing approximately 5 grams. In January of 2001, when the spot price for gold was $266.20, the melt value of this piece would have been about $25. By January 2016, with gold trading at $1,116.40, the same band would have had an estimated melt value of roughly $105. Today, using a spot price of $4,512 per ounce, that same gold band carries an estimated melt value of about $425.

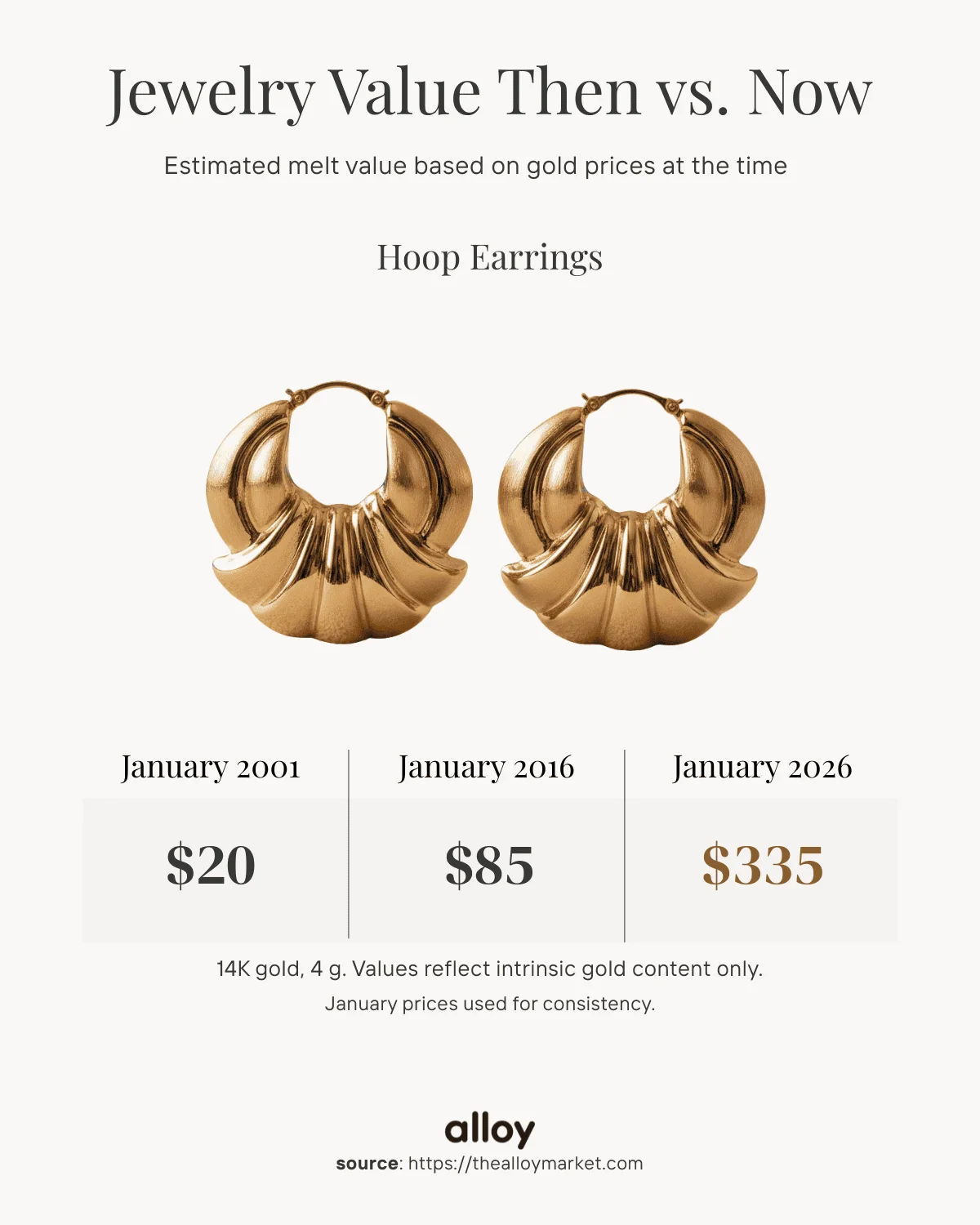

Hollow hoop earrings

Finally, the last example considers a pair of hollow 14K gold earrings weighing approximately 4 grams. When the spot price of gold was $266.20 per ounce in January of 2001, the melt value of this set would have been around $20. In January of 2016, gold was trading at $1,116.40 per ounce, bringing the melt value to around $85. Today, with a spot price of $4,512 per ounce, this retro set of earrings carries a melt value of around $335.

What Changed and Why

Taken together, these examples illustrate how changes in gold prices over time have translated to higher intrinsic values across a range of common jewelry types. Each piece was evaluated using the same assumptions regarding weight, purity, and pricing methodology, enabling consistent comparisons. While the heavier pieces and higher-karat gold naturally carry more value, the underlying pattern remains the same; jewelry that once held modest gold value can represent significantly more intrinsic value today as gold prices have risen.

Jewelry Value vs Inflation

During the same period, inflation rose, reducing the purchasing power of the U.S. dollar. The above figures are nominal gold prices rather than inflation-adjusted figures, but the comparison still provides insightful context. In many cases, the increase in the melt value of gold jewelry over the last 25 years exceeded the general rate of inflation, highlighting that changes in gold prices, rather than inflation alone, drove much of the value increase.

Why Jewelry Value Is Often Underestimated

Rarely do people purchase jewelry with investment value in mind. Instead, most pieces mark personal milestones or hold sentimental meaning. Once they are no longer worn regularly, people may store them away and often forget them. While styles change and personal preferences evolve, the intrinsic value of the gold itself continues to fluctuate with the market, independent of how often a piece is worn or revisited. Jewelry not only differs by style but also by construction, weight, and purity, which can often make it difficult to estimate its value intuitively.

Unlike traditional financial assets, gold jewelry is not something most owners actively track or revalue over time. Investors in stocks or funds may frequently monitor market performance, but those who own gold jewelry typically do not follow changes in gold prices. As a result, significant shifts in intrinsic value can occur quietly over long periods, without the owner realizing how much that underlying value has changed.

Methodology and Data Notes

The historical gold prices used in the comparisons above are based on monthly spot pricing data compiled from publicly available market sources. Current prices are based on spot price data captured at month-end from a third-party pricing API and labeled to the corresponding month for consistency.

Example pieces were selected to represent common gold jewelry sold both 25 years ago and today, using typical industry weight ranges. Prices are not adjusted for inflation and represent the intrinsic value of the gold present in each piece at the time noted.

Closing Takeaway

It’s not uncommon for people to have long-forgotten jewelry they no longer wear, tucked away in a jewelry box or drawer, as it quietly grows in value with the market. Over long periods of time, pieces that were purchased decades ago can carry significantly more intrinsic value today, even when resale or investment value was never part of the original consideration. Decisions about what to do with old jewelry are personal. This comparison isn’t about what to do next; it’s about seeing familiar objects through a different lens.