Where to Buy Gold: A Beginner’s Guide to Safely Buying Physical Gold

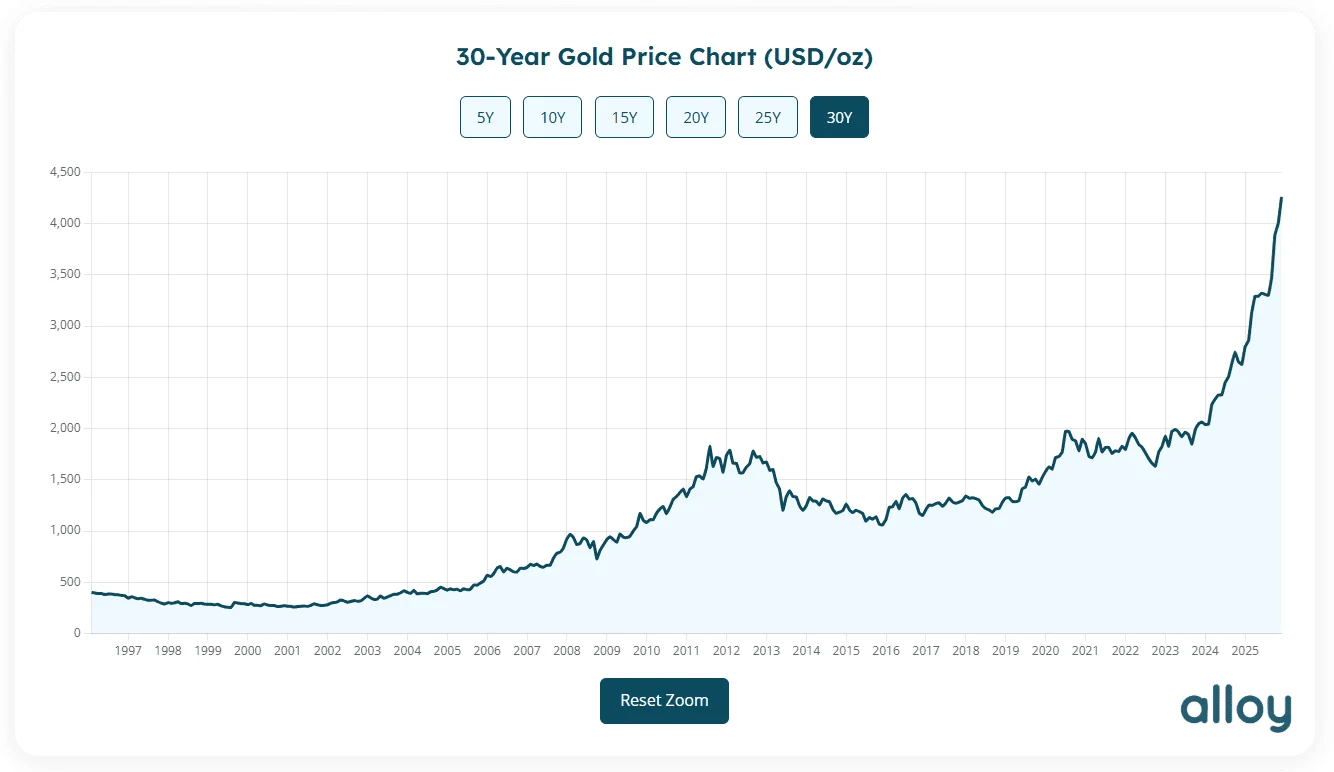

As 2025 brought record-breaking gold prices, people began to ask whether buying gold makes sense for them. Interest in gold often grows as economic uncertainty rises, driving people to safe-haven investments as a harbor for wealth.

For first-time buyers, knowing where to buy gold can be confusing. Prices vary from seller to seller, gold comes in different forms, and seller fees are not often transparent. Without a clear understanding of the gold market, it can be challenging to know whether a buyer is paying a fair price or buying from a reputable source.

This guide focuses on buying physical gold. It explains the most common places to buy it, how pricing and premiums work, and what beginners should consider before making a purchase.

In a nutshell

Buying physical gold usually means purchasing bullion coins or bars from online dealers, local coin shops, or other established sellers. Prices are based on the current gold spot price plus a premium that varies by product, seller, and market conditions. For beginners, starting with recognizable bullion from trusted mints, understanding storage and resale considerations, and knowing where to sell it later are just as important as finding where to buy it.

What Does “Buying Gold” Actually Mean?

There are many ways to gain exposure to gold, including stocks, ETFs, and retirement accounts, but this guide focuses exclusively on physical gold that one owns outright.

When people talk about buying gold in this context, they usually mean bullion. Bullion is a category of physical gold refined to the highest purity valued primarily by weight and purity. Gold bullion is most commonly sold in the form of coins and bars.

Gold coins

Gold coins are bullion products minted by governments or private mints. Common examples of bullion coins include the American Gold Eagle, the Canadian Maple Leaf, and the Gold Buffalo. Bullion coins are not the same as rare or collectible coins. Instead, their value is determined by weight and purity rather than numismatic or collectible value.

Coins typically carry higher premiums than bars due to minting costs, government backing, and higher demand for smaller, easily recognizable pieces. While they may cost more per ounce than bars, they can offer a liquidity that some bars do not. It’s easier to sell a small coin than a large bar.

Gold bars

Gold bars are another form of bullion that comes in standardized weights, such as 1oz, 10oz, and 1kg bars. Some bars come prepared to break into smaller segments, often called combi bars. These can offer added flexibility, but they usually come with higher premiums than standard bars and may be less widely accepted once separated.

Bars generally carry lower premiums than coins for a few reasons: they cost less to manufacture, do not require government minting, and larger bars can be harder to sell because they are a much more expensive purchase. More experienced collectors may choose to invest in large bars because they can purchase more gold at a lesser premium. Beginners commonly start with smaller sizes.

Where someone buys their gold affects how much they pay above spot and how easy it is to sell later. Large online gold dealers may offer lower fees because they deal in volume, while smaller local coin shops may charge more for convenience or specialized inventory. Buying widely recognized coins or bars from reputable sellers can make future resale easier, whereas lesser-known products may require additional testing to verify authenticity.

How Much Is Gold Right Now?

The price of gold, known as the spot price, changes throughout the day in response to global supply and demand. Gold prices often rise during periods of economic uncertainty or when the U.S. dollar weakens, as some buyers view gold as a way to preserve value.

The spot price serves as the baseline for valuing any piece of gold, but it is not the price most people pay when buying physical gold. Dealers use the spot price along with an item’s weight and purity to estimate the melt value, which represents the value of the gold content itself. Because bullion is refined to high purity and sold in standardized weights, its value is generally straightforward to calculate.

The final purchase price of physical gold is typically higher than the spot price due to dealer premiums, manufacturing costs, and distribution expenses. These expenses vary, which is why two sellers may charge different prices for the same amount of gold.

Checking the current spot price before buying or selling helps provide context for pricing and makes it easier to compare offers.

Current 24K Gold Price

How Much Does It Cost to Buy Gold?

When purchasing physical gold, buyers should expect to pay more than the spot price. Retail clients do not have wholesale access to gold at the spot price as gold dealers do, so there will always be a premium when buying from a dealer. Premiums account for manufacturing and minting costs, distribution, and dealer operating expenses.

In typical market conditions, many bullion products sell for a few percent above spot price, though premiums vary by product type, size, and market demand. Smaller items and widely traded bullion coins often carry higher premiums per ounce than larger bars.

How much money do you need to invest in gold?

Beginners can enter the gold market with relatively small purchases, such as a 1-gram gold bar or a small bullion coin like the Chinese Gold Panda. Larger purchases may involve fractional-ounce coins, full one-ounce coins, or gold bars weighing 10 ounces or more.

Smaller products offer accessibility, while larger products may provide lower premiums per ounce. The amount required to invest in gold depends on one’s budget, purchasing goals, and the balance between flexibility and cost efficiency.

How much will $10,000 buy in gold?

How much gold $10,000 will buy depends on the current spot price of gold and the dealer’s premium. Use the calculator below to enter the expected premium percentage, and it will estimate how much gold $10,000 will buy. This estimate is intended for comparison purposes only, as actual dealer pricing varies by product, availability, and seller fees.

Where to Buy Physical Gold

There are many options for purchasing physical gold, including local shops and online dealers. Each offers different benefits and drawbacks, so buyers need to decide what they value most before selecting one.

Local coin shops and bullion dealers

Local coin shops and bullion dealers are another common option for purchasing gold. These stores offer buyers the opportunity to interact face-to-face, to inspect the items in person before buying, and take their purchase home immediately, rather than waiting for shipping. For some buyers, seeing the gold before buying provides added confidence.

One limitation to buying locally is that inventory can be more limited than what is available through large online dealers. Selection often depends on what the shop has recently acquired, and availability may change frequently. Pricing also varies by location as local operating costs, regional demand, and inventory turnover all influence shop prices. Buyers may need to visit a few stores to compare prices.

Reputation is just as important here as it is in an online storefront. Buyers can start by talking to friends and family in the area to see if they have recommendations for a local seller. Checking online reviews is also essential. Reputable stores will have a consistent track record of positive customer feedback and transparent pricing practices.

Where to buy gold online

Online dealers are a popular option for purchasing gold bullion, as they often offer a much wider selection than local coin shops. Because many online sellers operate at a higher volume, pricing can be competitive, particularly for everyday bullion products. For these reasons, first-time gold buyers often make their initial purchase through established online dealers.

Before purchasing, it’s crucial to vet dealers carefully. Reputable dealers typically have consistent reviews across Google, Trustpilot, and the BBB. Product listings should clearly state the weight, purity, mint or refinery, and any applicable fees. All shipping should be insured and tracked to protect items in transit.

Taking the time to research online dealers and compare pricing helps buyers reduce risk and better understand what they are purchasing.

Buy Physical Gold and Silver with Confidence

- Buy Physical Gold and Silver from a Trusted Precious Metals Brokerage

- No Account Fees, Secure Payments, and Fully Insured Shipping

- Transparent Pricing with Expert Support at Every Step

Buy Physical Gold and Silver with Confidence

- Buy Physical Gold and Silver from a Trusted Precious Metals Brokerage

- No Account Fees, Secure Payments, and Fully Insured Shipping

- Transparent Pricing with Expert Support at Every Step

Alloy recommends Aurica as its preferred partner for buying gold because of its large selection and competitive pricing. Alloy may earn a referral or affiliate commission if a purchase is made through this link, at no extra cost to the client.

Can you buy gold at a bank?

In the United States, it’s uncommon for retail banks to sell physical gold directly to consumers. Rather than sell bars and coins whose value fluctuates, banks rely on traditional financial products such as savings accounts, loans, and investment services. In some countries, such as Canada, certain banks do offer physical gold for sale; availability and terms vary by institution.

Banks that sell physical gold may have limited options. Their products may be limited to a few specific items, minimum purchase requirements may apply, and pricing may be higher than other marketplace options. Buyers should contact the bank directly to confirm availability, pricing, and any additional fees.

So while a select few banks may sell physical gold, it isn’t typical, and most buyers rely on dedicated bullion dealers. With a broader selection, transparency, and ease of purchase, they are the standard in gold buying.

Where Is the Cheapest Place to Buy Gold?

The cheapest place to buy gold depends on several factors, including the seller’s premium, the product type, and current market conditions. Premiums vary by seller and location; that’s why it’s a good idea to purchase from dealers who clearly list their fees. These fees cover operating expenses such as sourcing, security, and logistics, and help ensure a transparent buying experience.

Product Type – The type of gold product someone buys also plays a significant role in pricing. Coins often command higher premiums than gold bars due to their intricate designs, government-minted status, and greater demand. Because bullion coins are widely recognized and easier to resell, buyers are often willing to pay more per ounce for that added liquidity.

Gold bars typically cost less per ounce than coins because they require less detailed manufacturing and focus primarily on weight and purity rather than design. Larger bars may carry lower premiums per ounce in many cases, but they can be harder to sell later due to their higher total value and more limited buyer pool.

Seller reputation – Seller reputation also affects pricing. An established, reputable seller will offer consistent, transparent pricing rather than unusually low prices meant to attract attention. Many buyers are willing to pay a slightly higher premium for the added certainty that comes with purchasing from a reputable source. Gold purchased from a reputable dealer is easier to resell because of that dealer’s reputation.

Buyback terms – In addition, reputable dealers may offer more transparent buyback terms than lesser-known sellers. Some will publish buy-back prices and are more willing to accept their own products, which can result in narrower buy-sell spreads. The buy-sell spread is the difference between the cost to buy gold and the price a dealer will pay to resell it. Dealing with established sellers often means this margin can be smaller.

Is It Better to Buy Gold Coins or Bars?

Whether it’s better to buy gold coins or bars depends on a buyer’s goals, budget, and need for flexibility. Gold coins are available in small denominations and are widely recognized, making them easier to authenticate and resell. Because smaller gold units appeal to a broader range of buyers, demand for bullion coins tends to remain strong at resale. As a result, gold coins often command higher premiums than gold bars.

Gold bars come in a wide range of sizes, from small fractional pieces to larger bars weighing a kilogram or more. Per ounce, bars typically have lower premiums because they are much simpler to manufacture and place greater emphasis on weight and purity rather than design. While larger bars can offer better value per ounce, their higher total cost may limit the number of potential buyers, reducing flexibility when selling.

How to Invest in Gold Coins and Bullion as a Beginner

Before purchasing physical gold, it helps to understand a few key factors that influence how easily gold can be bought, stored, and sold later.

- Start with smaller, accessible gold purchases – For first-time buyers, fractional gold products are often a practical entry point. Both coins and bars are available in smaller sizes, such as 1/20 oz gold coins or 1-gram gold bars, which allow buyers to participate in the gold market without a significant upfront commitment.

- Prioritize recognizable bullion over novelty items – While collectible or novelty gold pieces may be appealing, they often carry higher premiums and may not retain long-term value. Well-known bullion products from trusted mints are typically priced based on gold content and are easier to authenticate and resell.

- Choose gold that is easy to verify and liquidate – Gold products with standard weights, clear purity markings, and broad market recognition are simpler to sell later. Buyers are generally more confident when authenticity can be confirmed quickly and consistently.

- Keep thorough records of all gold purchases – Documentation such as receipts, invoices, original packaging, and seller information helps establish authenticity and ownership. Recording product details, weight, and purity also makes it easier to track value over time.

- Maintain records for resale and tax awareness – Accurate purchase and sale records can help owners understand potential capital gains considerations and support future resale. These records may also serve as proof of ownership in the event of loss or theft.

What Is the Most Reliable Place to Buy Gold?

There is no one most reliable place to buy gold. Instead, to best evaluate reliability, look at a few key characteristics.

- Transparent pricing – Reliable sellers clearly display base pricing, premiums, and applicable fees to avoid confusion. Transparent pricing allows buyers to understand what they are paying and makes it easier to compare offers.

- Established reputation – Seller reputation is an important indicator of reliability. Established dealers should have consistent reviews across multiple platforms. Note discussion about prices, transparency, customer service, and overall buying experiences.

- Clear buyback policies – Not all sellers offer buyback programs. When sellers provide buyback programs, the policies should clearly outline the pricing methods, procedures, and any requirements. Buyback programs can support liquidity by making it easier to resell gold, though they are not guaranteed to offer the highest price.

- Secure shipping or storage – When purchasing physical gold online, shipping should include tracking and insurance to protect items in transit. Some gold dealers offer on-site storage for those who don’t want to keep physical gold on hand. These services include fees and contract terms, and buyers should understand how to withdraw their gold if needed.

Reputable companies tend to emphasize complete transparency and well-established practices. While newer companies may have flashy deals or enticing offers, when dealing in precious metals, buyers often place greater value on reliability and clarity.

What Does It Cost to Store Gold?

Storing physical gold is an essential part of owning gold. There are two types to consider: on-site and off-site. Understanding the costs of gold storage is key to investing in physical gold, because they are often underestimated and can eat into marginal returns.

On-site storage

On-site storage refers to home safes, which don’t incur monthly fees, but make gold more susceptible to theft. The initial buy-in can range anywhere from a few hundred dollars to a few thousand, depending on the size. In addition to the up-front cost, one must insure the gold to protect the asset. Investors can get a specific insurance policy or add a rider to their existing homeowner’s or renter’s policy.

Off-site storage

Off-site storage options include professional vault storage, safe-deposit boxes, or gold-dealer bullion storage.

Professional vault storage

Security companies such as Brink’s, Loomis, and Malca-Amit provide professional vault storage, which typically includes 24/7 surveillance, reinforced vault construction, alarm systems, and insurance coverage.

Some vault providers offer services that facilitate liquidity by allowing stored gold to be transferred directly to a buyer without requiring physical withdrawal. In other instances, operators have arrangements with bullion dealers that enable sellers to transfer ownership of their gold directly to the dealer and receive payment without handling the metal.

Costs for this service-rich product are ongoing and, in some cases, incur transaction fees. Lower-cost monthly storage fees can hover around 0.06% of asset value, with a low minimum. Other high-end storage facilities include a monthly minimum of $39 and discuss pricing by phone. Storage costs and terms depend on the level of security, insurance, and liquidity services offered.

Safe-deposit boxes

Most banks offer safe-deposit box services that allow customers to store valuables in a secure vault. Clients benefit from the bank’s added security, but will still need insurance to cover their valuables, as banks do not insure the contents, and FDIC insurance does not apply.

Rental costs vary by location and box size, with annual fees ranging from $40 to almost $300. Owner access is limited to bank hours, which can be inconvenient if the gold needs to be retrieved quickly or outside regular business hours.

Gold-dealer bullion storage

Some gold dealers provide on-site storage as part of the purchasing process. When a buyer purchases gold from such a facility, they may choose to add storage at checkout rather than accepting physical delivery. In many cases, dealers provide storage through secure facilities operated by the dealer or through partnerships with professional vaulting services.

There are two types of dealer storage: allocated vs unallocated. Allocated means specific bars or coins are assigned and held in a buyer’s name. Unallocated implies the buyer has a claim to a certain amount of gold, but not to specific pieces. Cost and liquidity differ between the two types, with allocated storage typically being more secure and liquid.

Fees for dealer storage vary by provider and storage structure. Money Metals, for example, has a tiered storage system that starts at $96 a year for gold values of $0-$15,999 and increases from there. SD Bullion claims clients can store their gold for as low as $9.99 per month. Buyers should carefully review what each service includes and understand whether additional fees apply for withdrawing gold or accessing their gold storage unit.

Storage fees are an expense many first-time buyers overlook, but they can have a tangible impact on financial growth. Buyers should compare options and consider the security, convenience, and liquidity they value before choosing a provider.

Taxes, Reporting, and Buying Gold

Many first-time gold buyers are unsure if there are reporting or tax implications of buying gold. They often want to know if their large purchases are reported to the IRS, for example. Here are a couple of common questions and considerations to keep in mind before purchasing.

Does the IRS know when you buy gold?

Like many financial transactions, it depends. The IRS does not automatically know about every situation that involves someone purchasing gold. Instead, certain types of transactions can trigger mandatory reporting by sellers under federal anti-money laundering requirements.

For example, cash payments of $10,000 or more can require the seller to file an IRS/FinCEN Form 8300. This requirement also applies to smaller, related transactions structured within a short period to avoid the reporting threshold. The IRS defines specific rules for what qualifies as “cash” for reporting purposes.

When someone moves large amounts of money, in this case $10,000 or more, banks also have a responsibility to report. Neither of these reports has tax implications, however. The IRS uses them to track large cash transactions.

Are gold coins taxed?

There are different types of taxes to consider when buying gold coins. Sales tax on coins varies by state, and some states exempt certain bullion coins and bars or apply thresholds. Because sales tax is location-dependent, buyers should review their state and local requirements.

At the federal level, the IRS generally treats physical gold as collectible for federal tax purposes. As a result, profits will be taxed under the collectible capital gains framework, which can carry a higher maximum long-term tax rate than other capital assets.

No federal taxes are imposed when purchasing gold. Taxes typically apply only when selling gold for a profit. Because individual circumstances vary, buyers often consult a qualified tax professional to understand how current rules apply to them.

What Is the Downside of Buying Gold?

Buying gold comes with considerations, including price volatility, storage responsibility, and the lack of yield or interest.

While it’s often considered a long-term store of value, gold can fluctuate significantly over short periods. Gold prices respond to several global factors, including supply and demand, the strength of the U.S. dollar, interest rates, and inflation expectations. For first-time buyers, this volatility can make timing decisions more challenging, particularly for those with short-term investment goals.

Buying physical gold means it must be stored somewhere. For many, that means purchasing off-site storage services or buying a home safe. Unlike cash that is stored in a bank and spent digitally, physical gold’s value lies in the possession of the piece itself.

Gold also differs from other investment vehicles in that it does not produce income. Physical gold does not generate dividends or interest, and its value depends on current market conditions. While gold can help investors protect wealth during economic uncertainty, it does not offer the same wealth-building potential as stocks, bonds, or CDs.

Is Gold or Cash Better?

Both gold and cash have a place in an investment portfolio, though they play different roles. Cash is immediately liquid and widely accepted, making it easy to use for everyday transactions and short-term needs. Gold, on the other hand, while still liquid, depends on a sale before its value can be realized.

Cash allows for direct purchasing power, but its value can erode over time due to inflation. And while gold prices fluctuate, it has historically been used as a long-term store of value, particularly during periods when a currency’s purchasing power is down.

Income-generating options, such as high-yield savings accounts and CDs, apply to cash, but there are no ways to store physical gold that allow it to generate interest or dividends. Instead, its value is tied solely to the market.

Because of these differences, many people view gold as a complement to cash, rather than a replacement. People prefer cash for short-term expenses, emergencies, and daily transactions, but consider gold for long-term wealth preservation and diversification.

How to Cash Out Gold Coins or Bars Later

When someone buys physical gold as an investment, they will eventually want or need to sell it. Having an exit strategy is just as important as learning how and where to buy gold. While the spot price of gold sets the baseline price for an item, the amount a seller ultimately receives depends on the selling method, buyer type, and associated costs. Gold buyers must account for operating expenses, verification, and market conditions when making an offer.

Selling to a local gold buyer or coin shop

Local gold buyers and coin shops offer a convenient option for selling gold, particularly for those looking for a quick, in-person transaction. Pricing at these locations varies but is generally based on the current spot price, minus a margin to cover business expenses such as testing, refining, and resale. Shop around to compare offers between buyers.

Widely recognized bullion coins may command slightly better offers because they can be easily resold and authenticated. Coins with numismatic value should be evaluated separately from bullion coins, as their value may depend on rarity and condition, rather than the melt value alone.

Larger bars may be harder to sell locally because of their higher price and smaller buyer pool. Pieces manufactured by a private mint may require additional testing, which can delay the transaction process.

Selling through private or peer-to-peer markets

Private sales or peer-to-peer marketplaces may fetch a price closer to melt value, but can often be more challenging to facilitate. By joining a gold-buying community, online or offline, one can expand their network of potential buyers for face-to-face transactions. When arranging in-person exchanges, sellers typically prioritize discretion and choose secure, public locations for the transfer of ownership.

Peer-to-peer platforms allow sellers to list their items and sell to buyers either through auction-style or set-price listings. Some platforms, such as eBay, offer free authentication for higher-priced items, which can help to eliminate buyer hesitation. Even then, finding a buyer can take time for items that require high levels of trust. It’s not uncommon for these types of items to sit for weeks or months before selling.

Coins are far more practical for private or peer-to-peer sales as they require lower individual values and are easier for buyers to recognize and authenticate. Gold bars tend to be more challenging to sell this way due to concerns about value, trust, and safety.

Pawn shops and emergency liquidity

Pawn shops are widely known for providing quick cash in emergencies, making them a viable option in urgent financial situations. Because pawn shops prioritize speed and manage higher resale risk, offers are typically lower than those from specialized gold buyers or coin dealers.

It is easy to find a pawn shop in almost every major city in the U.S., so they are readily available. They are more willing to purchase smaller coins than large bars, as lower-value items are easier to resell, but may decline larger bars altogether.

Selling to a pawn shop may be appropriate in an emergency, but it’s not a go-to option. It is a convenience-based option rather than a value-maximizing approach.

Dealer buyback programs and stored gold

Depending on where gold is purchased, some dealers may provide a buyback program that allows customers to sell gold back to the original seller. Dealers who also provide storage services often offer these programs, as they can usually sell the gold without requiring physical withdrawal or additional shipping.

When dealers hold the gold in their own storage facilities, they can streamline the process, improving liquidity and reducing friction. Pricing through buyback programs may be competitive, but not guaranteed, and can vary based on market conditions, product type, and program terms.

Not all dealers offer buyback programs, and policies differ widely. Always understand the program’s terms at the time of purchase to understand how resale works.

Online buyers like The Alloy Market

Online gold buyers like The Alloy Market make selling gold from your home simple. Alloy offers free, insured, and tracked shipping to protect items in transit when sellers request a free kit. Once received, gold items are inspected and weighed, and sellers receive a detailed offer outlining each item and its corresponding payout.

When sellers accept an offer, we initiate payment on the same business day. If sellers have questions, they can contact their Alloy Advisor at any time during the transaction.

Understanding how to sell gold when the time comes is an essential part of buying physical gold. Having a clear plan for liquidation helps buyers avoid uncertainty and better evaluate where to purchase gold in the first place.

Conclusion:

Buying physical gold means more than deciding between coins or bars. Where someone purchases gold influences how much above spot price they’ll pay, how they’ll store it, and how easily they can sell it later. Different gold dealers offer different tradeoffs in terms of pricing, convenience, transparency, and liquidity.

For first-time buyers, understanding these differences helps set realistic expectations and reduces uncertainty. Factors such as seller reputation, pricing transparency, storage options, and buyback policies all play a role in the overall experience of owning physical gold. For different buyers, gold serves different purposes, whether that is diversification, long-term value preservation, or flexibility.

Gold ownership extends beyond the initial purchase. Buyers must consider all facets, including where to store it and how to sell it later. Choosing established, transparent sellers and understanding the full lifecycle of ownership allows buyers to approach physical gold with greater confidence and clarity.