How to Sell Gold Bullion: A Complete Guide for First-Time Sellers

Selling gold bullion is different from selling jewelry. Its value is based almost entirely on gold content and current market price. Understanding pricing and buyer offers is essential for first-time sellers learning how to sell gold bullion.

This guide outlines how gold bullion is valued, the factors that affect payout, and how sellers can navigate the process confidently and safely.

In a nutshell

To sell gold bullion confidently, confirm its weight and purity, check the current spot price, and evaluate multiple buyer options. Understanding how offers are structured helps sellers make informed decisions.

Understanding Gold Bullion and Its Value

What is gold bullion?

Gold bullion is investment-grade gold valued for its purity and weight, not for craftsmanship or design. It is typically sold as:

- Bars (1 oz, 10 oz, 1 kilogram, and larger)

- Government-issued coins (such as American gold Eagles or Canadian Maple Leafs)

- Privately minted rounds

Most bullion products are highly pure, often .999 or .9999 fine gold, which means 99.9% or greater gold content.

Gold is measured in troy ounces, not standard ounces. One troy ounce equals about 31.1 grams. The value of bullion is determined by its gold content (weight and purity) and the current market price, not by artistic or historical significance as with jewelry or collectibles.

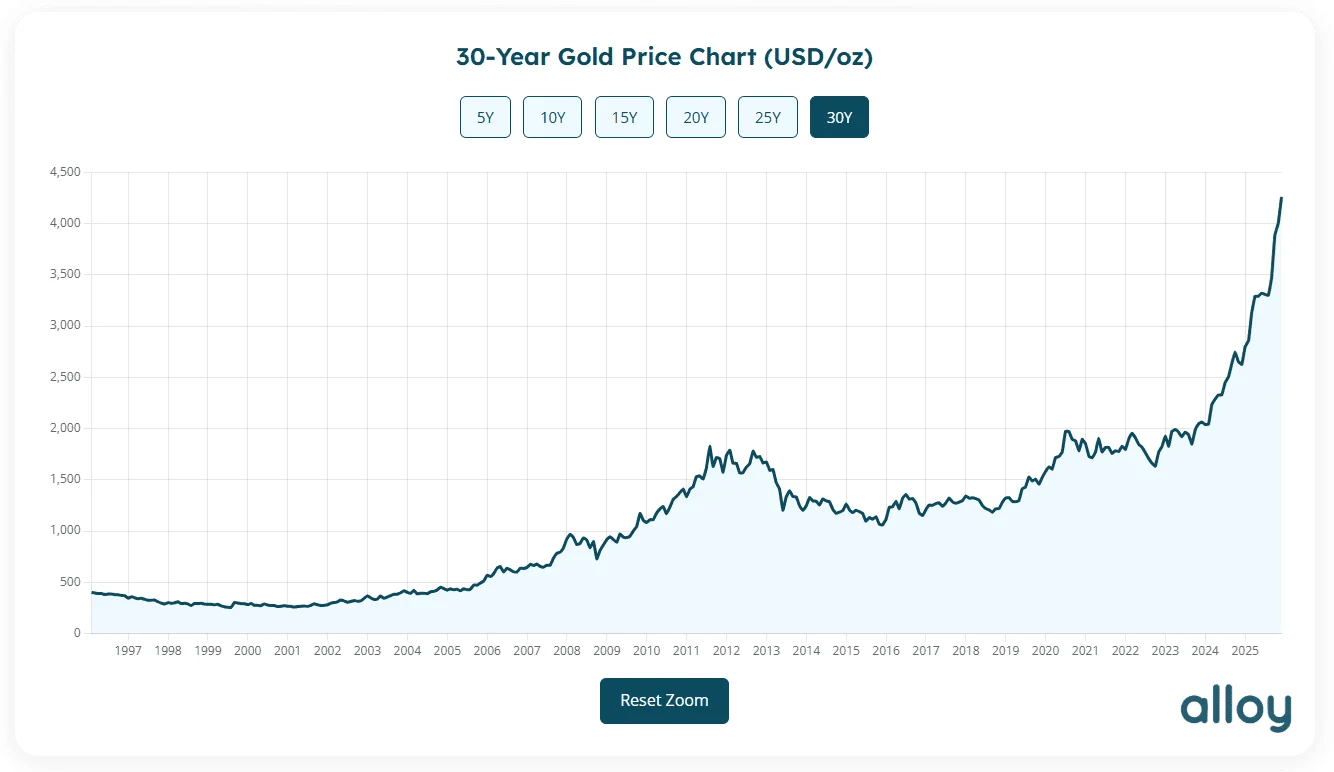

Current trends in the gold bullion market

Gold prices fluctuate with economic conditions. High inflation, political unrest, or recession concerns often increase demand and prices. In stable periods, prices may pull back. As a result, the timing of a sale can affect the final proceeds.

Factors affecting the gold bullion selling price

Four main factors determine the payout when selling gold bullion.

1. The purity and weight

Buyers determine a baseline value by multiplying the item’s gold content by the current spot price. This calculated melt value serves as the baseline for any offer.

2. The spot price

The current market price per ounce, known as the spot price, is a key factor buyers consider when making offers.

3. The dealer spread

The difference between the melt value and a buyer’s offer is the “spread,” which covers business expenses such as handling, verification, overhead, and market risk.

Spreads vary by buyer, so compare multiple offers before finalizing a sale.

4. Liquidity and verification

Buyers can more easily verify bullion with clear markings, assay cards, and serial numbers, thereby streamlining the transaction.

If packaging is missing or authenticity is uncertain, additional testing may be required, which can extend the transaction time.

Preparing to Sell Gold Bullion

Sellers can help ensure a smooth transaction by taking a few practical steps before selling.

Verify weight and markings

First, confirm the stamped weight and purity. If purchased from a reputable dealer, authenticity is likely. Weigh the item and check for recognizable mint marks or serial numbers.

Keep documentation

Original documentation, such as receipts, certificates of authenticity, assay cards, serial numbers, and packaging, can simplify and expedite the sale.

Check the current spot price

Knowing the current market value provides a reference for evaluating offers. Offers are typically below spot price due to standard business costs.

Choosing Where to Sell Gold Bullion

One of the most important decisions is where to sell gold bullion. The choice of buyer will impact how easy the process is, how safe the transaction is, and the price a seller can get.

| Buyer Type | Transaction Style | Pricing Structure | Speed of Payment | Quantity Requirements | Key Considerations |

|---|---|---|---|---|---|

| The Alloy Market | Remote, free insured shipping | Offer based on precious metal content and current market value | Same-day after acceptance | No minimum | Structured evaluation with tracked shipping; no account required |

| Local Coin Shops | In-person | Based on live market pricing and dealer spread | Immediate or same-day | Typically none | Limited to local demand |

| Pawn Shops | In-person | Based on resale margin | Immediate | None | Prioritize quick liquidity |

| National Bullion Dealers | Local or remote | Structured around live spot pricing | Varies | May require minimums | May require account registration; specialize in standard bullion formats |

The Alloy Market

The Alloy Market provides a remote selling option for bullion investors who prefer not to conduct in-person transactions. Sellers request a free evaluation kit and send their bullion for professional verification. Alloy provides free, insured, and tracked shipping for items in transit and offers free FedEx pickup.

Offers are issued based on precious metal content and current market pricing after weight and purity are confirmed. Because the process is fully remote, it can appeal to sellers who prioritize convenience and structured evaluation. There is no minimum to sell and no account required.

As with any buyer, sellers are encouraged to review terms and compare offers before proceeding.

| PROS | CONS |

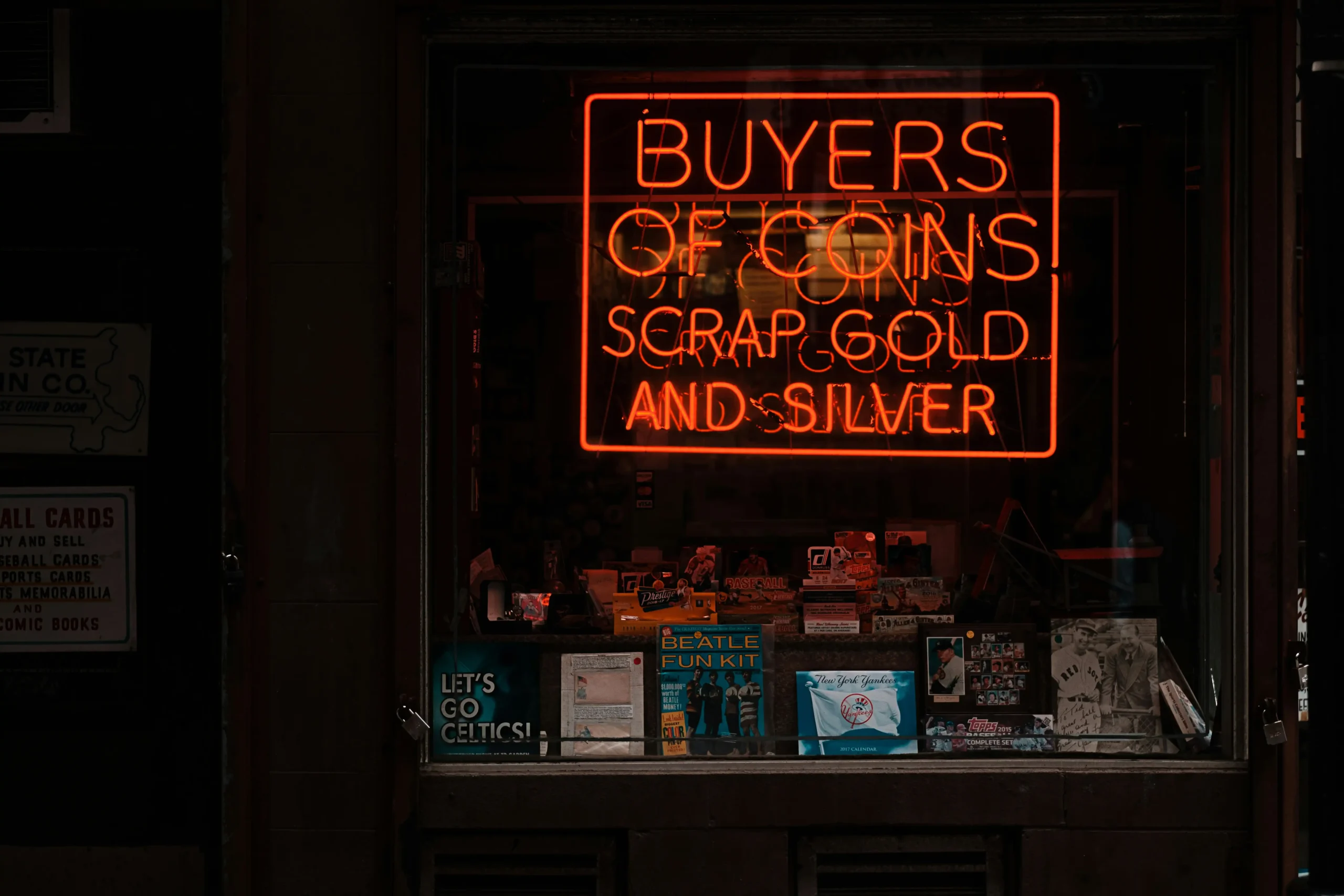

Local buyers

Local buyers include coin shops, jewelry buyers, cash-for-gold shops, and pawn shops. They offer in-person negotiation and immediate payout, but their offers depend on local market demand.

Offers can vary widely, so compare at least two before deciding.

| PROS | CONS |

Bullion dealers

Bullion dealers generally deal exclusively in investment-grade products. They are familiar with standard bullion formats, and their pricing is structured around the live market value. It’s not uncommon for bullion dealers to require a minimum quantity for sale.

These buyers are available both locally and online.

| PROS | CONS |

Selling Gold Bullion Safely

Selling gold bullion for cash is safe when approached carefully. Millions of people do this every day.

Recommended precautions include:

- Using licensed, established dealers only.

- Confirming shipping insurance and tracking if mailing in bullion

- Meeting in monitored locations for in-person sales.

- Requesting written confirmation of offers.

- Comparing fees and payout rates between different dealers.

Sellers should pause and request clarification if any part of the process is unclear or rushed. It is always acceptable to walk away if something feels wrong.

Tax Implications on a Profitable Gold Sale

Profits from selling gold bullion may be subject to capital gains tax.

If bullion is sold for more than its cost basis, the profit may be taxable. In the U.S., gold is typically classified as a collectible for tax purposes. For collectibles held over a year, the IRS sets a maximum long-term capital gains tax rate of 28%.

Sellers should consult a qualified tax professional to understand reporting requirements and potential capital gains obligations.

How to Sell Gold Bullion From Home with Alloy Market

If you’re ready to sell your gold bullion and want a simple, streamlined process that allows you to sell from the comfort of your home, consider selling with Alloy. Start by requesting a free evaluation kit. We’ll ship it right to your door and provide a postage-paid parcel for packing your items for assessment. You can drop off your package at the nearest FedEx location or schedule a free local pickup. Insurance and tracking are included, so you know your items are safe in transit.

Alloy does not require any minimums or an account to sell. We even offer upfront estimates via call, text, email, or our calculators.

The same day your items are received, we’ll evaluate them and send you a detailed offer. When you accept, we’ll issue your payment on the same day. If you choose not to, we will ship your items back to you at no additional cost.

Alloy Market is quickly becoming the go-to place for bullion and jewelry sellers alike. We have an A+ rating with the BBB, and 4.8 stars on TrustPilot. Check out the reviews from our happy customers. Request your free evaluation kit today to get started!