How to Sell Scrap Gold: A Comprehensive Guide

Broken chains, mismatched earrings, and old dental crowns all still hold value based on their gold content. Many people overlook scrap gold sitting in drawers, unaware they can sell it for immediate cash, regardless of condition.

This article will explain what qualifies as scrap gold, how to calculate its value, and where to find trustworthy buyers. By the end, readers will know how to sell scrap gold jewelry for the best price.

In a nutshell

Scrap gold refers to broken or unwanted gold that retains its inherent value due to the presence of precious metal content. Before selling scrap gold, it’s crucial to understand how the purity, weight, and spot price of gold interact to determine its value. When selecting a gold buyer, obtain multiple offers to compare what each buyer offers and which option best fits your needs.

Understanding Scrap Gold

Before selling, it’s helpful to understand what scrap gold is and why it’s valuable.

Let’s look at what qualifies as scrap gold and the factors that affect its worth:

What is scrap gold?

Scrap gold refers to any gold item valued for its metal content rather than its appearance or function.

These pieces are typically broken, damaged, or unwanted, and buyers purchase them to melt down and refine. The condition doesn’t matter; only the amount of actual gold it contains.

Here are some common examples of scrap gold:

- Broken or tangled jewelry chains

- Mismatched earrings or damaged bracelets

- Old class rings or outdated gold pieces

- Dental crowns, fillings, and bridgework

- Gold components from electronics

- Worn coins or bars that have lost collector value

Is scrap gold worth anything?

Yes, scrap gold holds real value based on its purity and weight.

Buyers calculate offers using the current market price of gold, then adjust based on the karat level of each piece. They then sell to refiners who melt down scrap gold to extract pure metal, which they resell to manufacturers for new jewelry, electronics, and other products.

The karat stamp determines how much pure gold an item contains:

- 10K gold contains 41.7% pure gold

- 14K gold contains 58.3% pure gold

- 18K gold contains 75% pure gold

- 24K gold contains 99.9% pure gold

Higher karat pieces yield better returns because they contain more actual gold. For example, a 10-gram 18K bracelet is worth more than a 10-gram 10K bracelet of the same weight. Buyers typically pay a percentage of the melt value to cover refining and overhead costs.

Preparing Your Scrap Gold for Sale

Understanding what scrap gold is and how buyers determine value is just the first step. Proper preparation is necessary for accurate appraisals and competitive offers.

Take these key steps before approaching any buyer:

Gather and sort your gold scrap

Start by collecting all gold items from around the house, from jewelry boxes, drawers, and forgotten storage bins. Use a magnifying glass to look for karat stamps, such as 10K, 14K, 18K, or 24K, on clasps, inner ring bands, or pendant backs. Sort items into separate piles by karat.

Then, remove any non-gold components:

- Gemstones and pearls (save these to sell separately if valuable)

- Non-gold clasps or findings

- Stones set in the metal

Check the spot price of gold

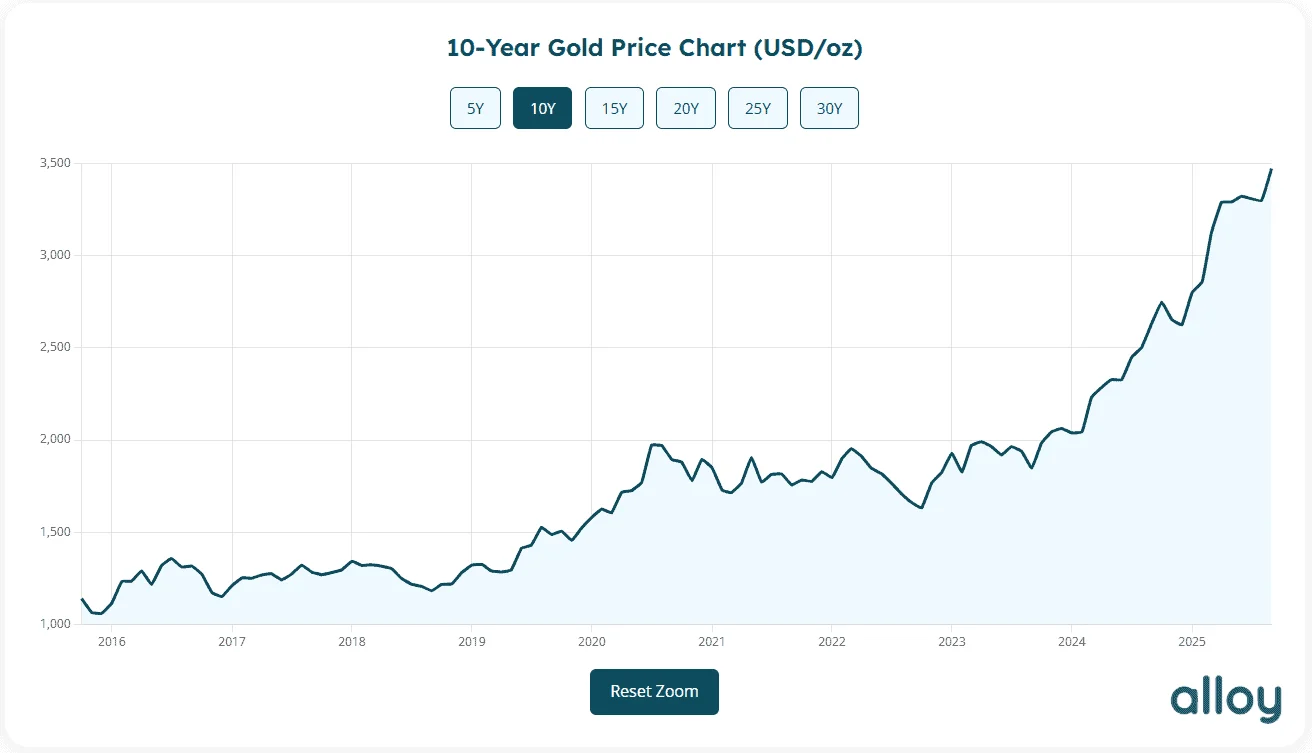

The spot price represents the current market value of pure 24K gold per troy ounce. This price fluctuates daily in response to global supply and demand. The Alloy Market’s Historical Gold Price chart helps track trends and identify favorable selling times.

Keep in mind that buyers won’t pay the full spot price for scrap gold — they typically offer only a percentage of the calculated value. The difference covers refining costs, overhead expenses, and the buyer’s profit margin.

To estimate scrap gold value, use this formula:

Value = (Karat ÷ 24) × Weight × Spot Price

For instance, if the spot price is $2,000 per troy ounce and someone has 10 grams (0.32 troy ounces) of 14K gold, the calculation would be (14 ÷ 24) × 0.32 × $2,000 = $373 for the gold’s melt value. At an 80% payout rate, for example, the offer would be approximately $298.

Choosing the Right Buyer

After sorting scrap gold and estimating its value, the next step is to decide where to sell it.

Different buyers offer varying payouts, convenience levels, and transaction speeds, which this article details below:

Cash-for-gold companies and pawn shops

Cash-for-gold buyers are prevalent throughout the United States, typically offering their services in most major cities. Their payout rates vary wildly, with some offering competitive prices and others offering lowball offers. Sellers usually have to haggle in person to get a decent offer, but they are still an option for people who need money quickly and don’t mind this process.

Pawn shops provide fast transactions with immediate cash payouts. However, their purchase offers may fall between 20% and 60% of the melt value, which is not ideal. Pawn shops provide the opportunity to retain ownership of an item using gold as collateral, a benefit that other gold buyers do not offer. They are a decent option if someone is in a pinch and needs cash the same day, but with their low purchase offers and the need for haggling, it’s not an ideal option for everyone.

Online scrap gold buyers

Online gold buyers offer a convenient alternative to selling locally. Most reputable platforms offer free mail-in kits with insured shipping, enabling sellers to complete transactions from the comfort of their own homes. Payment typically arrives within 24 hours of appraisal via direct deposit or PayPal.

Key benefits of using online buyers include:

- Competitive offers with the right buyers (sometimes higher than local options)

- Free shipping kits with full insurance coverage

- No pressure to accept offers immediately

However, always research buyers before shipping valuable items. Watch for red flags. Not all online buyers are created equal. When considering an online gold buyer, look for a company that offers the following:

- A minimum payout percentage of the current price of gold. Look out for companies that claim only up to a specific payout price percentage without stating their minimum offer.

- Upfront estimates. If a seller already knows what they have, a reputable buyer should be able to give an upfront estimate before shipping the items.

- Online self-service tools to get estimates, such as scrap gold calculators.

- A positive reputation. Check online reviews, Better Business Bureau ratings, and what others are saying about the company online.

The Alloy Market

The Alloy Market is an online gold buyer with a highly trusted reputation. Our online calculators provide sellers with a general idea of what to expect for their scrap gold without even leaving their house. We offer free mail-in kits with insured shipping and tracking, maintaining a transparent process throughout.

We are proud of our online reviews and Better Business Bureau A+ rating. We always offer a minimum payout of 60%, 70% if you use the calculators, and our average payouts are between 75% and 80%, even higher for gold coins or bullion.

Our Alloy Advisors are just a phone call or text away, ready to answer any questions and even provide free upfront estimates. There is never any pressure to sell, and our appraisals are free and come with no obligations. We also offer a guarantee that we provide the highest payout. If you receive an offer from any other gold buyer, present the offer to us, and we can meet or beat it.

Alloy buys scrap gold

Request a free Alloy Appraisal Kit, ship from home, and receive a same-day offer after appraisal.

Alloy buys scrap gold

Request a free Alloy Appraisal Kit, ship from home, and receive a same-day offer after appraisal.

Selling Your Scrap Gold

Once sellers understand their buyer options, the focus shifts to securing competitive offers.

The following steps help maximize payouts and complete transactions with confidence:

How to sell scrap gold for the best price

Start by calculating the melt value using The Alloy Market’s Scrap Gold Calculator, which factors in karat, weight, and current spot price. This baseline helps sellers recognize fair offers and spot lowball attempts.

An option next step is to collect quotes from different buyers to compare and evaluate the offers. Most gold payout rates can vary wildly depending on the type of gold buyer and the individual company.

When selling locally, don’t be afraid to negotiate:

- Mention competing offers to leverage better prices.

- Ask buyers to explain how they calculated their offer.

- Request written quotes before committing.

- Walk away from pressure tactics or vague pricing.

How to personally sell gold scrap

In-person transactions require bringing a valid, government-issued ID, as laws dictate that dealers verify identification.

Sellers should observe buyers weighing and testing items in front of them. Never let pieces disappear into a back room. This transparency ensures accurate assessments and prevents item switching.

Before accepting any offer, ask these critical questions:

- Are there deductions for melt weight or processing?

- What hidden fees apply to the final payout, if any?

- Is the quoted price the net amount after all charges?

- How did you arrive at this specific offer?

Tip: Visit local coin shops, precious metal dealers, and jewelers for competitive quotes. Request itemized written offers that show the complete calculation. Comparing offers from multiple locations on the same day gives leverage for negotiating better prices.

Current Trends in the Gold Market

Gold prices hit record highs this year — nearing $4,000 per ounce in October 2025. Economic uncertainty and inflation are prompting more investors to turn to gold as a safe-haven asset. The market trends make it an excellent time to sell gold jewelry and scrap gold.

Demand for scrap gold remains high as buyers compete for available inventory. The 30-year gold price chart from The Alloy Market illustrates the dramatic price increase over the past few years, helping sellers understand the current favorable conditions.

The Alloy Market Buys Scrap Gold

If you’ve got scrap gold sitting in your jewelry box that you’re looking to sell, The Alloy Market makes it simple. Just request a free Alloy Kit to get started.

Use the provided postage-paid package to ship your items to us, ensuring they are insured and tracked for delivery. When they arrive, our experts will conduct a thorough inspection and provide you with an offer, along with a detailed breakdown of the findings. When you accept the offer, we will initiate payment the same day.

Our Alloy Advisors are available to answer your questions throughout the process. We want you to feel comfortable and well-informed throughout the entire thing. Join the thousands before you and let The Alloy Market become your go-to gold buyer.