Best Way to Sell Gold Coins: An In-Depth Guide

Gold coins are thought to be a hedge against a volatile economy, but the majority of the metal’s accumulated value is either lost or captured during the actual liquidation process.

The average person selling their gold would never know how the US gold market operates behind the scenes, and when there is a significant discrepancy between the spot price reported in the news and the actual cash offer when trying to sell, it can be incredibly frustrating.

After reading, sellers will know how to identify coins, evaluate their value, choose the right selling method, and confidently navigate every step to get the best possible offer.

In a nutshell

The best way to sell gold coins depends on what you have and how quickly you want to sell. Bullion coins are valued mainly by their gold content, while rare or collectible coins can be worth far more due to condition and demand. Understanding the difference between spot price, melt value, and numismatic premiums helps sellers avoid low offers and choose the right selling option for the best payout.

Understanding Gold Coin Selling Trends

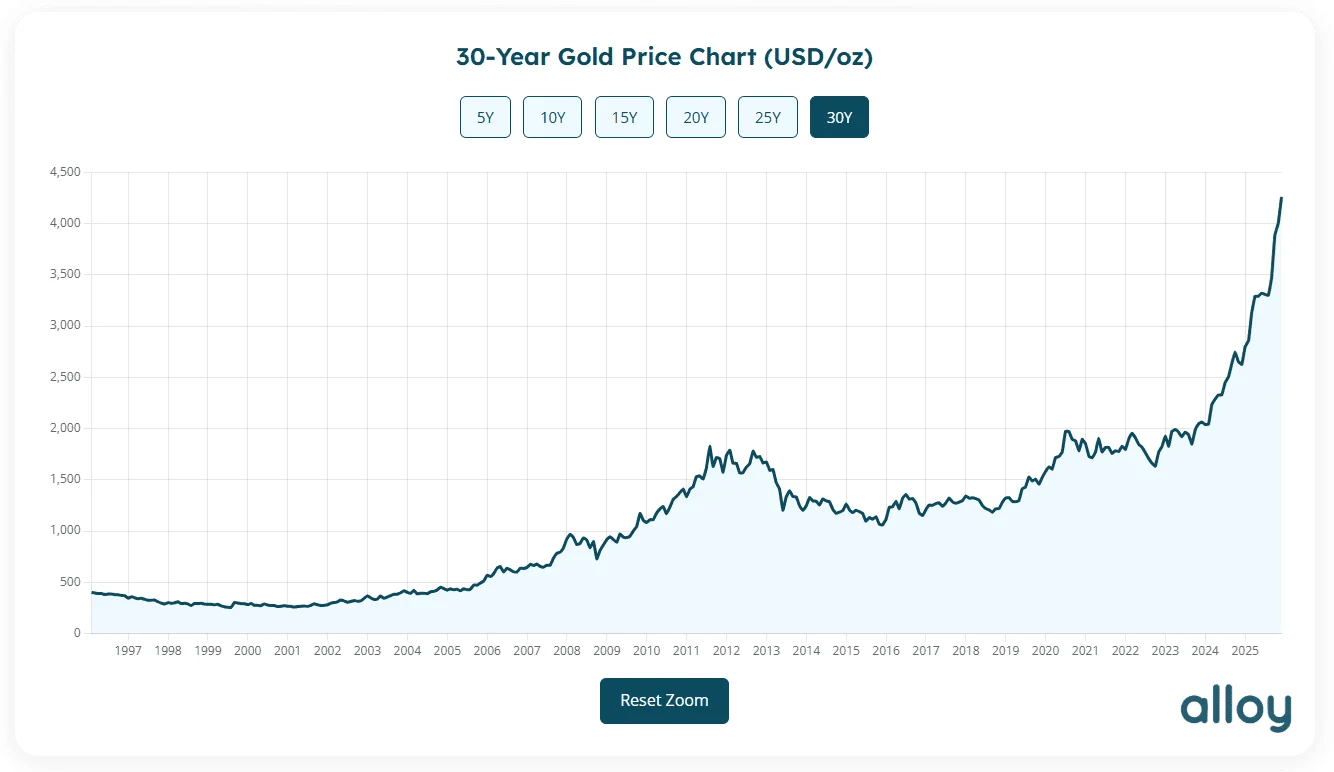

As investors flocked to this traditional safe haven amid high inflation, geopolitical tensions, tariffs, and central bank buying, gold rose by 65%, pushing spot gold close to $4,500 per ounce by late 2025 and to record highs over $5,000 per ounce in early 2026.

These trends mean the bullion market is very strong, though gold coin prices don’t always move with spot prices. The buy rates of coin dealers are largely determined by supply and demand rather than by the spot market alone. Even though gold prices are rising, a dealer may pay less than spot if they are overstocked.

Besides, the spot price will almost always be less important than the type of coin it is. A regular-old one-ounce bullion coin will closely track the market, but a rare numismatic coin will be worth so much more because of its rarity and the collector demand.

Long story short, what someone is selling (bullion versus collectible) matters more than this week’s gold price movement, especially considering what historical gold prices have been.

How to Evaluate Gold Coins for Sale

Before choosing where to sell, one needs to understand what kind of gold coins they have, since different coins are valued very differently.

Assessing Coin Value

Gold coins differ from one another. While some are literally worth just their weight in gold, collectors place a much higher value on others.

First, sellers need to ascertain whether the coin is numismatic or bullion. Because bullion coins are more prevalent and primarily derive their value from their gold content, they closely track market prices. Due to their scarcity and desirability, numismatic coins, which are rare or historical coins, limited-mintage issues, proofs, etc., can be worth significantly more than their gold melt value.

Next, determine how much gold the coin contains. Purity can vary, and common sizes include 1 oz. or fractional weights. Buffaloes or Canadian Maple Leafs are 24-karat pure gold, whereas US Eagles are 22-karat, or approximately 91.7% gold.

Finally, rarity, age, and mint condition will change the coin’s value. A 100-year-old coin with a low mintage, being in excellent condition, and with an error will have collectors literally fighting to buy it.

Authentication and Condition

An expert coin appraiser can determine whether a coin is fake, assess its rarity, and identify physical characteristics that could reduce its value. This helps prevent inadvertently misrepresenting a coin or selling a rare coin for its melt value.

Professional certification from Professional Coin Grading Service (PCGS) or Numismatic Guaranty Company (NGC) grades the coin on a 70-point Sheldon scale. It’s because of this grading system that high-grade coins sealed in a PCGS or NGC slab are much easier to sell and can fetch a higher price.

- If the coin shows no wear, its Mint State (MS) grade is 60-70.

- AU (About Uncirculated) indicates only minor wear.

- Lower grades, such as EF (Extremely Fine) or VF (Very Fine), indicate that the coin is not in the best condition but is still in decent condition.

- Lastly, Poor (P), Fair (Fr), Good (G), and Very Good (VG) indicate that the coin has problems.

Gold Coin Pricing Considerations

The first factor influencing the price of gold coins is their weight and purity. A coin’s base bullion value is determined by its gold content; the heavier and purer the coin, the higher its base bullion value. This melt value calculation, which can be monitored on The Alloy Market, is where most gold coin prices begin.

The price of coins can fluctuate in tandem with the gold market. The current spot price of gold serves as a benchmark for dealers and buyers when valuing gold coins. Online resources can be useful; to see an estimate of the coin’s melt value at the current price, enter weight and karat into a gold price calculator. Please be aware that these calculators only provide a melt value.

Because demand from buyers will be higher, pricing a coin with collectible value will be considerably more difficult. Melt value calculators don’t account for numismatic premiums at all, so sellers need to look up recent sale prices for that particular coin or get an expert appraisal.

Additionally, coins certified by PCGS/NGC or in better condition will fetch higher prices.

Choosing the Right Selling Option for Your Coins

| If you are… | Then… |

| Selling standard bullion coins | You’ll want to find a professional gold buyer or dealer |

| Selling rare or collectible coins | Look for selling spots that are targeted at collectors |

| In need of immediate cash | Go to a local shop to get same-day payment |

| Wanting the maximum payout and can wait | Use online services or marketplaces |

| Wanting safety & certainty | Look into insured mail-in services that have transparent, low-risk procedures |

Common Ways to Sell Gold Coins (and When Each Makes Sense)

There are several ways to convert gold coins into cash, each with its own advantages and disadvantages. The main choices are selling to a gold dealer such as The Alloy Market, selling through peer-to-peer marketplaces, visiting nearby stores, or locating private investors or collectors.

Selling Gold Coins to The Alloy Market

For those who want a secure, transparent, and easy way to sell gold coins, they should consider selling to a reputable mail-in gold buyer like The Alloy Market. This works well for both bullion and collectible coins, especially if the seller wants to avoid listing each item separately or dealing with in-person haggling. The whole process takes around 3-7 days.

Peer-to-Peer Marketplaces

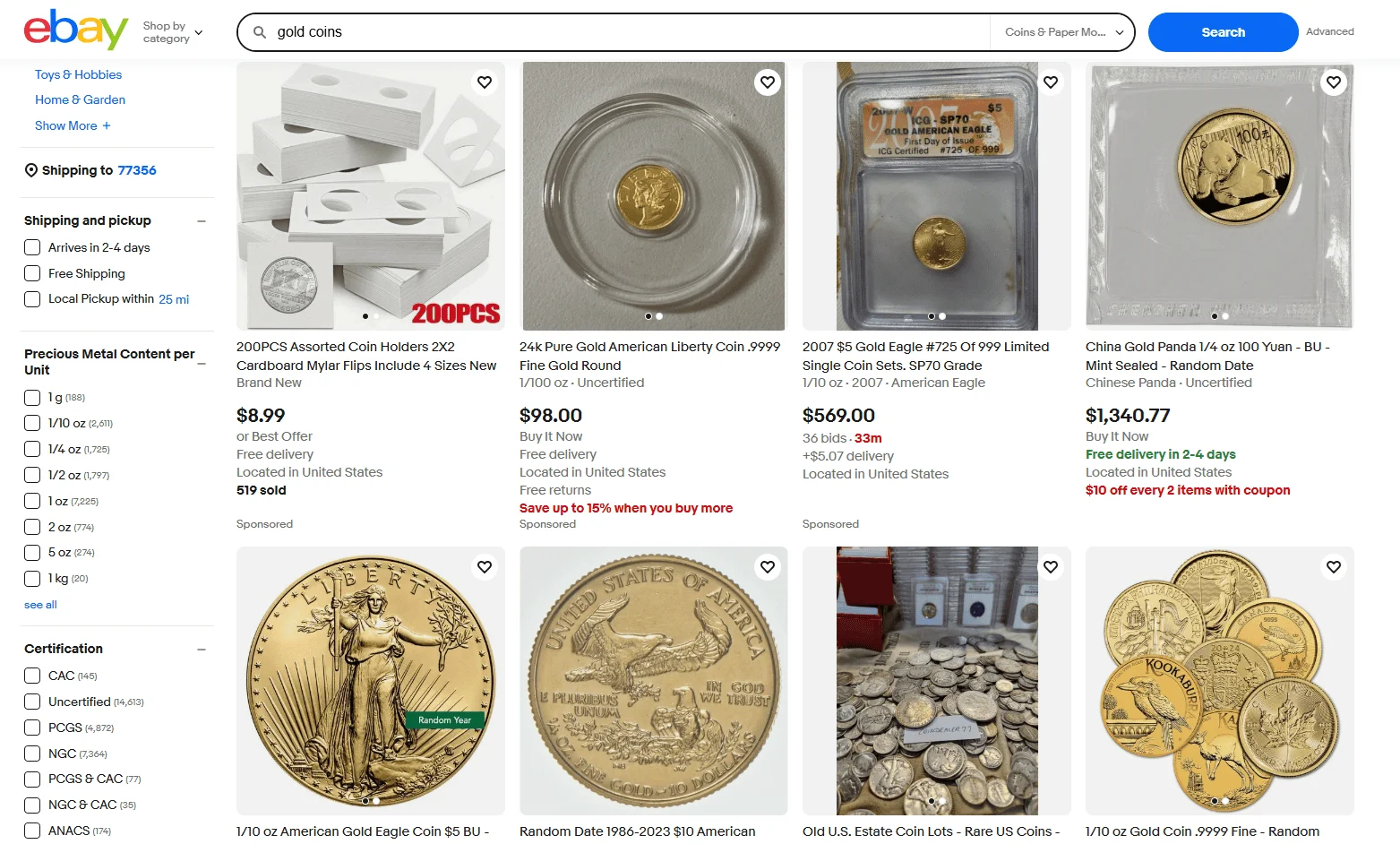

For sellers of rare coins who are ready to put in the time and effort needed to increase their returns, peer-to-peer platforms such as online auctions (eBay) or coin forums are fantastic.

These marketplaces carry a low to moderate risk of fraud or chargebacks and require additional labor, including photography, listing, negotiation, and shipping. Sales results vary greatly and can take weeks or months. However, if the right buyer is found, this method permits pricing above melt value for numismatic coins with high collector demand. While sellers may be able to secure a higher offer, they should consider any seller and/or listing fees that could eat into profits.

Local Dealers

The quickest way to sell a gold coin is through neighborhood coin stores and precious metal dealers, who can do same-day assessments and payment. This works best for bullion or common coins and for those who want quick cash or an in-person sale.

Although offers on coins can differ and may be more conservative than you’d expect, the process is simple and generally safe.

Selling to Collectors and Investors

For high-value numismatic coins where getting the most money is more important than selling quickly, private sales to collectors or investors through coin clubs, shows, or online communities are best.

The downside, though, is that networking and documentation are really the only ways to reach serious buyers.

For security, payments may be handled by an auction house or an escrow service. For certified or historically significant pieces, this offers the highest potential return, though sales timelines vary significantly.

What is the Best Way to Sell a Gold Coin?

| Selling Option | Speed | Complexity | Risk | Best For |

|---|---|---|---|---|

| The Alloy Market | 3–7 days | Easy | Low | Sellers who want high payouts and convenience |

| Peer-to-Peer Marketplaces | Weeks to months | Hard | Moderate | Collectors willing to do the work for higher prices |

| Local Coin Shops | Same day | Easy | Low | Fast cash when you trust a local expert |

| Collectors | Varies | Hard | Low | High-value numismatic coins |

| Pawn Shops | Same day | Easy | Moderate | People who need cash now |

Steps to Sell Gold Coins for Cash

Preparing Coins for Sale

- Do not clean rare coins. Polishing a tarnished coin to make it look shinier is not worth it, as it can actually reduce the coin’s value.

- Take good photos and make a list of everything to be sold, including the coin’s year, mint, denomination, and any unique characteristics.

- Get an appraisal/grading if there is uncertainty about the coin’s value. While expensive, PCGS/NGC grading can pay off by attracting better offers.

- While it’s hard to time the market perfectly, avoid selling into a weak market if there is time to wait. Additionally, hold off on selling if the coin is missing documentation or the value is unclear.

Negotiating a Competitive Offer

Get Multiple Quotes

If possible, try to speak with two or three buyers to compare their offers. Depending on their needs, a local store might offer 90% of the spot price, whereas an online dealer might offer 93%. One buyer may recognize the rarity of your coin and decide to pay more. On a high-value coin, even a slight variation (like 5% more) can have a big impact.

Know the Difference Between Spot Price vs. Melt Price vs. Numismatic Premium

- The current market price per ounce of pure gold is known as the spot price.

- The melt price, determined by the spot price, is a coin’s raw gold value based on its weight and purity.

- The value a coin gains above its melt value due to rarity, age, condition, or collector demand is known as the numismatic premium.

First, determine the approximate spot price of the coin’s gold content before accepting any offers. Use online calculators for this. If the coin is collectible, determine its numismatic premium by looking at price guides or recent auction results.

Be Patient and Don’t Take the First Offer if it Feels Low

High-pressure tactics like “price is dropping fast, sell now!” or “this offer is only good if you agree immediately,” are used to pressure sellers into making quick sales. Unless someone is literally at a pawn shop window, in need of fast cash, they have the right to take their time and consider offers. Most legitimate offers will be valid for at least that day, if not longer. And if someone is mailing coins, they’ll typically have a window to accept or decline after hearing the quote.

The Alloy Market Buys Gold Coins

When you’re ready to sell your gold coins, consider selling with Alloy. Prices are based solely on the precious metal content, making Alloy a great option for bullion coins and older coins with little numismatic value.

To get started, request a free evaluation kit. We’ll ship it right to your front door and provide a free, prepaid, insured parcel to ship your items to us. Our team of professionals will evaluate your pieces upon arrival and send you a detailed, itemized offer. When you accept, we initiate payment on the same business day. Sellers keep 100% of the quoted price; there are no hidden fees or charges. If you decline, we’ll ship your items back at no additional cost.

Our growing reputation speaks for itself; just read the reviews from our happy customers. Alloy is quickly becoming one of the most trusted, go-to buyers of gold and other precious metals.