How to Sell Gold: A Beginner’s Guide to Getting the Best Value

If someone doesn’t know how to sell gold, doing so for the first time raises numerous questions. What’s it worth? Who pays fair prices? How does one avoid getting ripped off? Without basic knowledge about purity, market rates, and buyer practices, sellers often accept offers that are hundreds of dollars below what their gold is worth.

This guide covers the essentials for selling gold with confidence and securing the best possible price, from evaluating items to selecting trustworthy buyers.

In a nutshell

Selling gold comes down to three key factors: knowing what you have, understanding its purity and weight, and selecting a buyer who meets the needs most important to you. Most sellers get underpaid simply because they don’t check current gold prices, fail to compare offers, or don’t understand how karats affect the value of their gold.

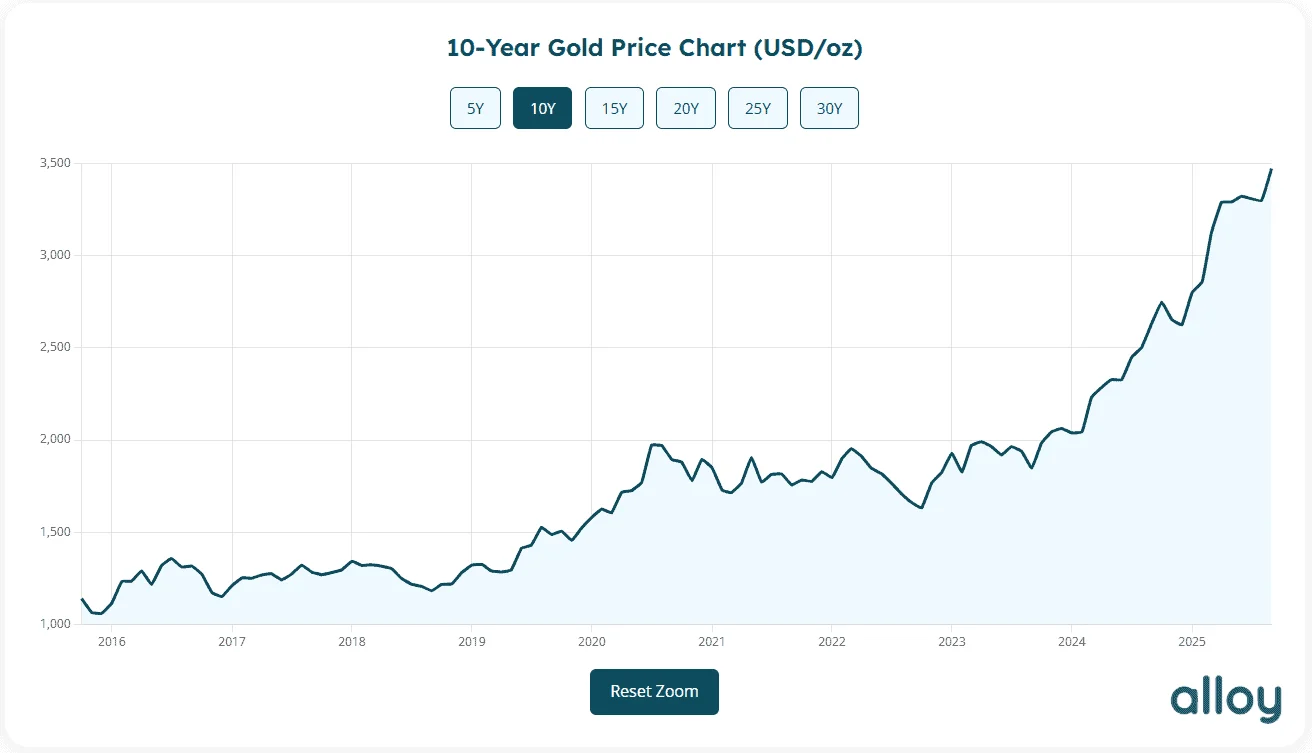

Understanding the Current Gold Market

Before selling gold, it is helpful to understand what factors influence its value.

Gold prices shift daily based on supply and demand. When economic uncertainty rises or inflation fears grow, investors turn to gold as a safe-haven asset, pushing prices higher.

Supply remains relatively stable since mining production changes slowly. Factors such as geopolitical tensions and investor sentiment have a more immediate impact on prices. The Alloy Market’s Historical Gold Price tracker shows these trends and helps identify favorable selling periods.

Types of Gold You Can Sell

Different forms of gold have different value factors and selling options. Jewelry, coins, bars, and dental gold each require distinct evaluation methods depending on purity, condition, and market demand.

Alloy Buys All Types of Gold

Request a free Alloy Kit, ship from home, and receive a same-day offer after evaluation.

Alloy Buys All Types of Gold

Request a free Alloy Kit, ship from home, and receive a same-day offer after evaluation.

Selling gold jewelry

Buyers value gold jewelry — including rings, necklaces, earrings, and watches — primarily by karat purity and weight. Most buyers calculate offers based on melt value, which reflects the amount of pure gold in each piece.

The karat rating affects what buyers are willing to pay. 24K gold is 99.9% pure and commands higher prices per gram. Meanwhile, lower karats, such as 18K, 14K, and 10K, contain less pure gold (75%, 58.3%, and 41.7%, respectively). This purity difference means that two items of equal weight can have drastically different values depending on their karat content.

While most buyers focus on melt value, condition can matter with some. Damaged or worn pieces almost always sell as scrap gold. However, jewelry in excellent condition may attract specialized buyers or auction houses willing to pay premiums for resale-ready pieces.

Designer pieces with unique craftsmanship add value only with the right buyer — think collectors or estate jewelry specialists (not local pawn shops). For example, a Cartier bracelet may be worth more than its melt value. However, general gold buyers often overlook these factors and pay based solely on the gold content.

For sellers looking to maximize the payout of their designer pieces, they may consider selling on platforms that specialize in designer and high-value items, such as The RealReal or Vestiaire, or selling peer-to-peer on marketplaces like eBay. Some local jewelers may be interested in purchasing pieces with excellent resale potential.

Selling gold coins and bars

When selling gold bars and gold coins, note that they typically display purity ratings stamped as .999 (99.9% pure). Legitimate bars include hallmarks showing the refinery’s stamp, weight, and purity from reputable mints. These markings verify authenticity and serve as the basis for determining fair market value.

Beyond their gold content, some coins carry collectible value. Rare coins with historical significance or limited mintage command premiums well above melt value.

Certification status also affects resale value and ease of sale. Third-party grading services verify authenticity. These certified items typically sell for higher prices and attract a greater number of buyers. On the other hand, non-certified items sell closer to melt value and may face skepticism from buyers.

Selling dental gold

Dental gold differs from jewelry in that it utilizes alloys specifically designed for durability rather than purity.

Most dental pieces are made from 10K to 22K gold, as pure 24K gold is too soft to withstand the forces of chewing. Manufacturers mix gold with metals like palladium or silver, meaning dental gold typically contains between 48% and 67% pure gold.

Since visual inspection can’t reveal the true purity of dental gold, accurate valuation requires professional testing. Experienced buyers measure the exact gold content and then calculate offers based on weight, karat level, and the current spot price.

Sellers have a couple of buyer options for dental gold:

- Specialized refineries offer the highest payouts and pay sellers based on current market prices for gold, platinum, and palladium. These buyers work with sellers who have large quantities of dental gold, such as dentists or orthodontists.

- Dental scrap buyers work with refineries and offer in-office visits or mail-in services.

Where to Sell Gold

After understanding what types of gold hold value, the next decision involves where to sell.

Selling gold online vs. in-person

Both online and in-person methods come with trade-offs worth understanding.

The table below breaks down key differences to help sellers decide which approach fits their needs:

Best places to sell gold

There are many avenues for selling gold.

The following table compares common buyer types to help sellers make wise decisions:

Comparing Gold Selling Options: Online, Local, and In-Person Buyers

Protecting against scams and lowball offers requires careful vetting:

- Check reviews. Look for consistent positive feedback on Google Reviews and Yelp to verify legitimacy. Better yet, visit websites such as the BBB and TrustPilot, whose primary purpose is to collect reviews.

- Request upfront estimates. Trusted online buyers provide estimates before requiring sellers to ship items and offer free insured return shipping for declined offers.

- Demand transparent testing. Legitimate buyers explain their testing methods and provide detailed breakdowns based on weight, purity, and current spot price.

Tip:

Watch out for red flags, including high-pressure sales tactics, too-good-to-be-true offers, and hidden fees.

How to Prepare Your Gold for Sale

Walking into a sale unprepared often leads to accepting the first offer without knowing if it’s a fair one. The sections below cover how to assess purity and sell gold for top dollar.

Evaluating your gold’s value

Accurate evaluation starts with determining weight and purity.

Take these steps to assess gold at home before seeking professional appraisals:

- Weigh the gold. Use a precision digital scale (0.01 gram accuracy) to measure exact weight in grams or troy ounces.

- Check the karat stamps. Use a jeweler’s magnifier (at least 10x magnification) to locate and read karat markings like 10K, 14K, 18K, or 24K on clasps, inner bands, or pendant backs.

- Estimate value. Use online calculators to get preliminary estimates. The Alloy Market’s pricing tool takes into account weight, purity, and current spot prices to provide realistic valuations that help sellers recognize fair offers.

Steps for selling gold bars, coins, and jewelry online

Once sellers know the value and karat level of their gold, the next step is to choose a buyer and complete the transaction.

Here’s how to sell gold online in five steps:

- Find a reliable buyer. Research several online gold buyers and verify their credentials through the Better Business Bureau. Compare quotes from at least three dealers to ensure fair market value and look for transparent pricing policies.

- Request a mail-in kit. Expect to receive a free, insured shipping label and secure packaging, along with detailed instructions from the gold buyer.

- Insure and track your package. Pack the gold according to the instructions. Then, ship it via the specified trackable service, such as FedEx or UPS. Retain all shipping documentation and monitor the package until delivery confirmation is received.

- Receive and approve the quote. The buyer authenticates and appraises the gold, then provides a final offer. Sellers must approve this offer to finalize the sale.

- Get paid. The buyer releases payment via check or a secure method (e.g., bank transfer).

Pricing and Costs Involved in Selling Gold

Buyers typically pay a percentage of the spot price, keeping the difference to cover operating costs, testing, and profits. Online buyers typically offer the highest percentages because they have lower overhead costs compared to physical locations. Pawn shops often pay the least (30% to 60%).

Beyond buyer margins, processing fees apply to scrap or impure gold. Refiners charge per troy ounce or take a percentage of the recovered value to extract pure gold. Buyers deduct these fees from the seller’s final payout.

Shipping costs add another expense for sellers who mail their gold. Secure shipping and insurance may be a flat fee or a percentage of the item’s value. But reputable buyers, including The Alloy Market, provide free insured shipping to eliminate this cost.

How easy or hard is it to sell gold?

Selling gold is straightforward once sellers know what to look for. Standard jewelry, coins, and bars have transparent pricing tied to spot rates, making it simple to compare offers. Sellers who research current prices and get multiple quotes can finish the process within days.

Gold teeth are more challenging because purity varies significantly. Dental pieces are made from gold mixed with various alloys, which require lab testing to determine their exact value. General buyers often avoid dental gold or offer minimal payouts since they lack specialized equipment to verify the content.

Collectible coins are more complex since they don’t follow standard bullion pricing. A rare coin’s value depends on its historical importance, condition, and scarcity — not just its gold weight. Sellers need patience to find collectors willing to pay premiums.

Is It a Good Time to Sell Gold?

Gold prices in 2025 are at all-time highs, creating strong selling opportunities for most.

That said, ideal timing depends on a few factors:

- Economic conditions: Gold prices tend to rise during periods of uncertainty and high inflation. When conditions stabilize or interest rates rise, prices typically fall as investors shift their focus to other assets.

- Seasonal patterns: Prices typically strengthen from January through March due to new year buying and Chinese New Year demand. August through October also see higher prices driven by the Indian wedding season and Diwali celebrations.

- Investor activity: Heavy inflows into gold exchange-traded funds (ETFs) or increased central bank buying signal strong demand supporting higher prices.

- Personal needs: Sellers who need cash now shouldn’t wait indefinitely for ideal conditions.

Tip:

Track market movements using The Alloy Market’s Historical Gold Price tool to identify peak selling periods based on recent data.

Selling Your Gold with The Alloy Market

The Alloy Market is quickly becoming the preferred gold buyer for numerous sellers seeking to maximize their payout from the comfort of their own homes. We make the entire process simple and straightforward from start to finish. Just read what our happy customers have to say!

To get started selling with Alloy, simply request a free, no-obligation Alloy Kit. We’ll ship it directly to your doorstep right away. Inside, you’ll find a postage-paid parcel to pack your items. Ship them back to us with tracking and insurance included. That way, you know your items are safe.

Once your items arrive, our team of experts will test and weigh your valuables and send you an itemized offer. When you accept on any business day before 5 PM, we’ll issue your preferred method of payment the same day.

If you have any questions at any time during the process, your Alloy Advisor is just a text, phone call, or email away. We look forward to working with you.